New Palmerston North rating valuations reflect buoyant property market

Palmerston North City property owners will soon receive a Notice of Rating Valuation in the post with an updated rating value for their property.

The new rating valuations have been prepared for 34,031 properties on behalf of the Palmerston North City Council by Quotable Value (QV). They show the total rateable value for the City is now $32.8 billion, with the land value of those properties now valued at $18.7 billion.

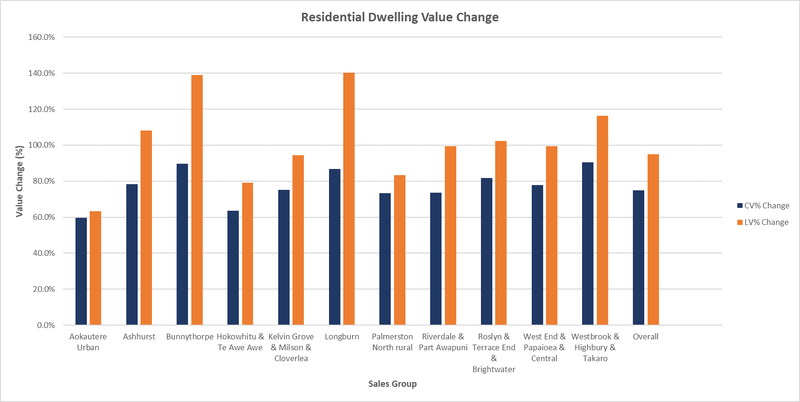

On average, the value of residential housing has increased by 75% since 2018 with the average house value now sitting at $776,000, while the corresponding average land value has increased by 95% for an average of $490,000.

Local QV senior consultant Simon Willocks commented: “We have seen continued value lifts across the entire residential market since 2018. A shortage of listings, record low borrowing costs and FOMO trumped other market uncertainties – including the impact of Covid-19, loan to value ratios and regulatory changes – as investors and first-home buyers fuelled the residential market.”

“The demand for sections and new builds were also major drivers of increased values,” he added.

Commercial, industrial, rural + lifestyle properties

The commercial and industrial sectors have had moderate increases across the city. Commercial property values increased by 26% and property values in the industrial sector have increased by 44.7% since the city’s last rating valuation in 2018.

Commercial and industrial land values have increased by 40% and 60% respectively. Value movements in the city have been similar to the trends in the wider region as traditional retailing properties struggled compared to fringe modernized spaces.

Since 2018, the average capital value of an improved lifestyle property has increased by 66% to $1,200,000, while the corresponding land value for a lifestyle property increased by 75% to $616,000.

Mr Willocks said the strength of the lifestyle market typically aligned with high-end residential properties. “This segment of the market has seen a surge of interest for well-located vacant land and established rural-residential properties,” he said.

“The smaller rural sector in Palmerston North City had moderate value increases and are often underpinned by their location and strength of the lifestyle market.”

Residential housing value changes since 2018 revaluation levels:

It is helpful to remember the effective rating revaluation date of 1 September 2021 has passed, and any changes in the market since then will not be included in the new rating valuations. This means in many cases a sale price achieved in the market today may be different to the new rating valuation set as at 1 September 2021.

The Palmerston North City Council will use the new values as the base for setting rates from 1 July 2022. Steve Paterson, the council’s Strategy Manager – Finance, said council staff were now reviewing the values to assess the impact on rates for individual properties.

“It is important to realise that changes to values does not increase or decrease the total rates revenue for the council,” he said. “Instead, rates will be spread amongst ratepayers in slightly different proportions than before.”

“Because residential land values have increased at a faster rate than other sectors, residential properties will pay a larger share of the total rates than at present when the new values are used as the base for the rates calculations.”

Council’s decisions about proposed rates from 1 July 2022 will be shared with the public as part of the consultation for its annual budget scheduled for April 2022.

What are rating valuations?

Rating valuations are usually carried out on all New Zealand properties every three years to help local councils set rates for the following three-year period. They reflect the likely selling price of a property at the effective revaluation date, which was 1 September 2021, and do not include chattels.

The updated rating valuations are independently audited by the Office of the Valuer General and need to meet rigorous quality standards before the new rating valuations are certified. They are not intended to be used as market valuations for raising finance with banks or as insurance valuations.

New rating values will be posted to property owners after 1 December 2021. If owners do not agree with their rating valuation, they have a right to object through the objection process before 29 January 2022.

Find out more about the rating revaluation and objection process.