New rating valuations for Kaipara District

Kaipara District property owners will soon receive a Notice of Rating Valuation in the post with an updated rating value for their property.

The new rating valuations have been prepared for 15,794 properties on behalf of the Kaipara District Council by Quotable Value (QV). They show the total rateable value for the district is now $10,786,318,000 with the land value of those properties now valued at $6,091,456,000.

Rating valuations are usually carried out on all New Zealand properties every three years to help local councils set rates for the following three-year period. They reflect the likely selling price of a property at the effective revaluation date, which was 1 September 2020, and do not include chattels.

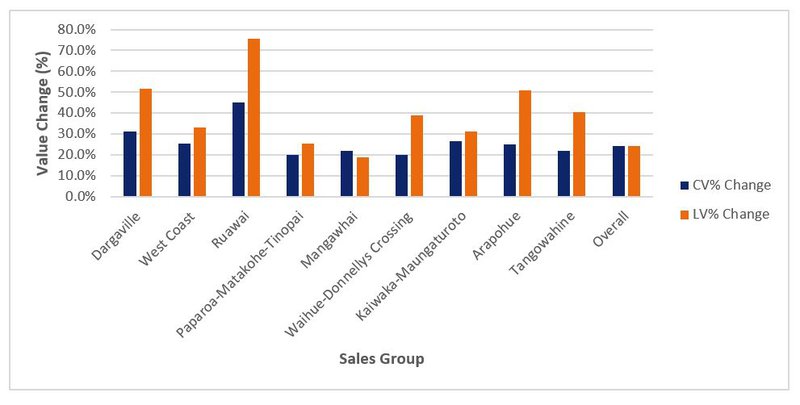

On average, the increase in land value across the district is 17.5%. The value of residential housing has increased 24.2% since 2017 with the average house value now sitting at $625,600, while the corresponding average land value increased by 24.4% to an average of $297,000.

QV valuer Liz Jones commented: “The demand for residential housing was buoyant across the Kaipara region, with most townships in the district seeing increases of between 15-40% overall. Demand for sections has also been strong, and as a result land values have increased 24.4% for the district overall.”

“There have been significant value lifts across the entire residential market since 2017 with values still rising strongly. Lower value properties have seen the most competition from buyers and has resulted in the greatest value increases. Demand from buyers coming from outside the region has helped fuel the market. This demand extends to holiday homes, where we are still seeing increases for waterfront properties.”

Meanwhile, commercial property CV values have increased by an average of 19%, and property values in the industrial sector have increased by 17.6% since the district’s last rating valuation in 2017. Commercial and industrial land values have also increased by 22.7% and 40.4% respectively.

“Retail and commercial office properties have seen lower increases in value than the residential property market,” said Liz Jones. “In Dargaville, there is some demand from buyers for good quality properties with favourable leases in place although there are a lot of older buildings requiring maintenance. In Mangawhai, this demand is higher with a more buoyant retail market. This has been offset to a small degree by online competition for retailers and the start of a post lockdown trend for more people to work from home although there is good activity in the main shopping areas that are well supported by locals.

“There are steady value increases for industrial properties, and a limited supply of industrial land within the region has seen a boost in land values”. Most of the old stock has now been sold with few commercial or industrial properties available.

Residential housing value changes since 2017 revaluation levels

Since 2017, the average capital value of an improved lifestyle property has increased by 20.7% to $747,000, while the corresponding land value for a lifestyle property increased by 23.9% to $330,800.

Lifestyle properties typically align in value with high-end residential properties and this segment of the market has been buoyant.

The market for pastoral properties is relatively stable. Smaller grazing blocks, and blocks with good contour continue to sell well with good demand for quality rural properties across all categories. The majority of interest comes from local farmers, along with some interest from people outside the region.

There are large percentage value increases in the central and western side of the District coming off low base levels and good demand for central Kaipara blocks with harbour views. Well-presented lifestyle properties surrounding Mangawhai with unimpeded outlooks and quality improvements are also fetching premium prices. Overall change in CV values for pastoral farms is 6.4% and dairy farms 1.8%.

It is helpful to remember the effective rating revaluation date of 1 September 2020 has passed and any changes in the market since then will not be included in the new rating valuations.

This means in many cases a sale price achieved in the market today may be different to the new rating valuation set as at 1 September 2020 and that rating valuations are not designed to be used as market valuations for raising finance with banks or as insurance valuations.

The updated rating valuations are independently audited by the Office of the Valuer General and need to meet rigorous quality standards before the new rating valuations are certified.

New rating values will be posted to property owners after 3 February 2021. If owners do not agree with their rating valuation, they have a right to object through the objection process before 12 March 2021.

Find out more about the rating revaluation and objection process.