QV House Price Index, December 2021: Housing market ‘pumps the brakes’ − now what’s in store for 2022?

A remarkable year for New Zealand’s residential property market has come to an unremarkable end, with a flood of new listings helping to dampen home value growth but also failing to stop it altogether.

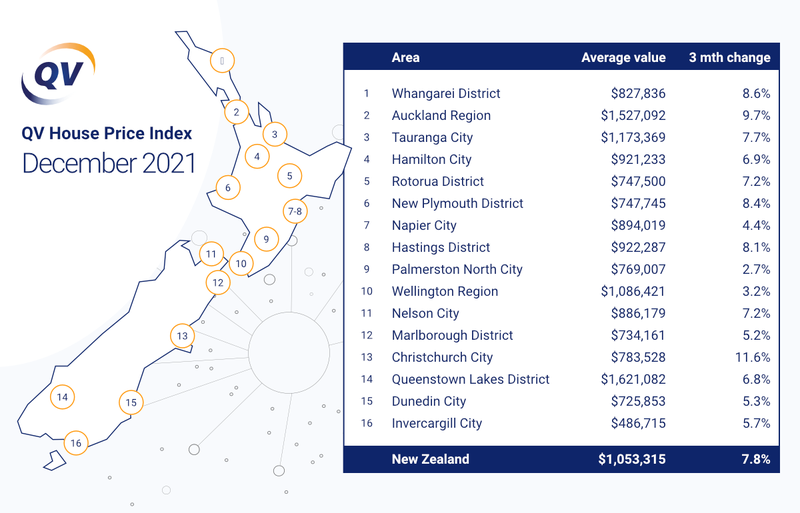

The average home increased in value by 7.8% nationally over the past three-month period to the end of December, up from the 6.9% quarterly growth we saw in November, with the national average value now sitting at $1,053,315. This represents an average annual increase of 28.4% for 2021.

In the Auckland region, the average value now sits at $1,527,092, climbing 9.7% over the last three-month period, with annual growth of 29.1%, increasing from the 27.9% we reported in November.

QV Operations Manager Paul McCorry commented: “It is fair to say that 2021 was a pretty unusual year for the property market. Never in recent times have we had so much external intervention in a housing market and yet, in the midst of a global pandemic, the market grew by a record 28.4% nationally.

“It became pretty clear towards the end of the year that this level of growth was not going to continue indefinitely as we started to see a decline in the quarterly rate of growth.”

Last month, we reported that three quarters of the major urban areas we monitor were still seeing an increase in the rate of quarterly growth. This time around, half are now showing a decline. “To be clear, they are all still seeing values go up – but at a much slower pace,” Mr McCorry added. “Of the other half that are still showing an increase in the rate of growth, five have increased by less than 1%. The market has definitely pumped the brakes, but it hasn’t ground to a halt completely.”

He said Christchurch City was the obvious winner of the unwanted ‘biggest increase’ title in 2021. The Garden City saw values lift a staggering 40.2% year on year, “a symptom of a market a little earlier in the growth cycle, where relatively speaking things were a little more affordable”. In real terms, that means in January 2021 the average Christchurch house price was around $560,000; today it is $785,000. Whilst the rate of growth has slipped a little this quarter, it is still in the double digits over a three-month period at 11.6%.

“Aucklanders have been doing the hard yards for the rest of Aotearoa throughout 2021, moving through the various lockdowns and traffic lights. After over 100 days in lockdown it is no surprise to see the Super City catching the wave of a now internationally recognised trend – a post lockdown boost to the property market, up 9.7% over the quarter. A prolonged period at home and now a relaxing of these restrictions will have people taking stock of their living arrangements.”

At every summer barbeque the conversation will have inevitably turned to what the market will do in 2022, but Mr McCorry said predictions can be fraught with danger. “Following the March 2020 lockdowns, doom and gloom was rife with predictions of a market correction. Yet since March 2020 values nationally have increased almost 41%. So what do the next 12 months have in store? Inflation and the interaction with interest rates will be key,” he said.

The Reserve Bank of New Zealand measures the average increase in the cost of goods and services and aims to keep that rate of price inflation between 1-3%. The third quarter result was 4.9% – so considerably higher than expected.

“The most likely lever to reduce this rate going forward is to increase the Official Cash Rate (OCR), which in turn increases interest rates banks will offer to prospective homeowners. We saw successive increases in the OCR in October and November, and it is no surprise that this was when we started to see the tide turn a little in the rate of growth,” said Mr McCorry.

“At this point in time, despite these increases, interest rates are still considered low by historic standards and this has most likely prevented the market being absolutely stuck in the mud. But any more increases could start to make both banks and their borrowers feel pretty nervous. More rigorous lending criteria that came into effect in December will also have banks really scrutinising every application.”

Meanwhile, in recent months we have seen quite a flood of listings to the market, mainly as people tend to hold off putting their home up for sale until the good weather. With increased listings, buyers have more choice.

“They won’t attend every open home and you won’t get as many multi-offer situations. The chatter about properties being handed in at auction is real, as is property sitting on the market beyond the initial tender period – often re-listed with an asking price. Managing vendor expectations coming out of 2021 and into 2022 will be a very advantageous skill set for an agent,” Mr McCorry added.

“If we had to draw a line in the sand, you could reasonably expect values growing in the smaller single digits towards the middle of the year and potentially remaining stable throughout winter, but 12 months is a very long time in a property market and realistic pricing and realistic vendors will prevail in 2022.”

Auckland

Auckland’s residential property market ended the year on a high – but there are growing signs that the market is beginning to turn.

Home values increased across the region by an average of 9.7% in the final three months of 2021 to a new average of $1,527,092. That figure is 3% higher than it was at the end of November, which means the region’s property values are increasing at a rate just greater than the national average (2.3%).

Auckland’s property market was hottest around its northern and southern boundaries in 2021, with Franklin (40.1%), Papakura (38.7%), and Rodney (33.3%) experiencing the greatest capital gains annually. Manukau (31.7%) and Waitakere (29.7%) weren’t far behind, while the North Shore and central Auckland suburbs still had impressive gains of 25.7% and 22.5% respectively.

Waitakere, the North Shore, and Auckland City were the only former territorial authorities across the Super City that didn’t experience double-digit property value growth in the three months to 31 December 2021.

Despite this, local QV registered valuer Hugh Robson said the market appeared to be slowing. “There has been a marked increase in the number of properties being passed in at auctions, likely as a result of the new LVRs and increasing interest rates.

“Agents have also reported a reduction in numbers attending open homes. It’s difficult to say how much of this can be attributed to the typical slow down around Christmas and New Year. We will know more when we see the QV figures for January and February.”

“Anecdotally, we’re even hearing of increasing numbers of buyers making somewhat cheeky offers on Auckland homes, looking to nab a bargain, whereas for large portions of the past year buyers would have had to put their best foot forward to be successful in the market,” Mr Robson added.

Northland

Northland’s residential property market continues to blaze away into summer, with average home values increasing by even more in the three months to the end of December than in the previous period.

In the Far North, the average home value has increased by 11.2% in the final three months of 2021 to reach $751,203. Annually, home values have increased by a remarkable 35.7% – well above the national average of 28.4%.

Values increased by almost as much across the Whangarei District, where the average house value increased by 8.6% over the last three months and 30.2% over the entire year to reach $827,836.

In Kaipara, the average home value is $906,557 – 14% higher than it was three months ago, and a resounding 37.7% higher than the same time last year.

Tauranga

Home values continue to climb ever higher in Tauranga – but there are increasing signs of a slow-down on the horizon.

The city’s average home value increased by 30.5% in the 12 months of 2021, including 7.7% in the three months leading into the Christmas and New Year holiday period. It is now sitting at precisely $1,173,369.

QV property consultant Derek Turnwald commented: “The Tauranga residential market performed strongly in 2021 with high buyer confidence, continued low interest rates early in the year, and an economy which, despite the uncertainty created by Covid-19, is performing comparatively strongly. The population of the city is growing rapidly and a large number of new dwellings was built on the periphery of the city, particularly in Pyes Pa and Papamoa.

“Changes to tax laws pertaining to property ownership – particularly for investors – and rising interest rates in the latter part of the year has dented that confidence in the market. Though properties continue to sell well and values continue to rise, the sentiment is that the residential market is likely to cool off in 2022.”

Mr Turnwald said the number of open home attendees had already dropped off considerably. “The market quietened down more than usual over the Christmas and New Year period. Bank lending continues to tighten and first-home buyers are finding it harder and harder to get lending approved. Mid-to-high value range properties continue to sell reasonably well, but the numbers of prospective buyers looking to purchase has decreased.”

Waikato

2021 was a hot year across the Waikato region, with property values increasing by an average of 34.7% overall.

The hottest district was Thames-Coromandel, where home values increased by an astonishing 43.8%, followed by Waitomo (43.6%), Waikato District (42.8%), and Taupo (40.1%). The smallest capital gains were recorded in Hauraki District, where home values still increased by a large average margin of 27.4% over 12 months.

QV property consultant Tom Schicker commented: “Like everywhere else in New Zealand, the Waikato region’s housing market has been fuelled by a number of micro and macro factors – including pent-up demand, overflow of buyers from higher priced Auckland market, low LVRs, and record-low interest rates, lack of supply and increasing construction costs, just to name a few. Also with borders closed, many Kiwis have chosen to invest in the property market with extra disposable income saved from not going on holiday. This all contributed to what was a record year of home value growth.”

Meanwhile, Hamilton property values increased at an average rate of 29.1% over the 12 months of 2021, slightly above the national average of 28.4%. Its average home value now sits at $921,233.

“Whether or not Hamilton will reach the $1m threshold before the property market eventually stabilises remains to be seen,” said Mr Schicker. “We’re already starting to see the market dynamics shift as a result of changing regulations and increasing interest rates making lending harder to come by. These headwinds are likely to intensify, making it harder on buyers and sellers.”

“With the average median house price for Hamilton City nearing $1,000,000, agents are still reporting that due to shifting market sentiment the mid to lower end of the Hamilton market has become less active. This has resulted in properties priced above $1,000,000 seeing most of the activity in the market. The northern suburbs of Hamilton City are seeing the highest volume of sales which are also overall the highest value suburbs in Hamilton,” Mr Schicker added.

Rotorua

Rotorua’s residential property values increased by an average of 22.4% in 2021 − a remarkable figure in any other year, but well below the national average of 28.4% over the past 12 months.

In the three months leading into the Christmas and New Year holiday period, Rotorua’s average home value increased by 7.2% to $747,500, a slight drop from the 7.5% figure we reported last month.

QV property consultant Derek Turnwald commented: “2021 was a year in which the Rotorua housing market continued to perform strongly with limited listings, strong buyer confidence and high value increases − although changes to tax laws and increasing interest rates have slowly eroded the high confidence in the market.”

He said local real estate agents had been reporting decreasing numbers of participants at auctions and open homes. “First-home buyers are finding it very difficult to get finance. Loan applications are being scrutinised much more than previously. This is resulting in fewer buyers being able to secure lending,” he said.

“There is a sense that the market is shifting to slightly favour buyers a little more. Buyers have less competition and less time pressure in making decisions. Vendor expectations remain high and in some cases have become unrealistic. Many people are now waiting to see what impact the new omicron variant of Covid-19 will have on the economy and therefore the housing market.”

Taranaki

Taranaki’s residential property market is a picture of consistency this month, with its three-monthly average rate of value growth sitting at just above 9%, similar to last month.

At 33.1% annual home value growth, Taranaki ended 2021 well above the national average of 28.4%. South Taranaki District led the way on 41.5% average value growth over 12 months, followed by Stratford (33.9%) and New Plymouth (31.6%).

In New Plymouth, home values increased by an average of 8.4% in the three months leading into New Year’s Eve. The average home value in the city now sits at $747,745.

Hawke’s Bay

Hawke’s Bay experienced some of the largest capital gains in the country last year, with the average home value rising by an incredible 34.4% across the region in 2021.

The biggest annual gains were recorded in the Wairoa District (38.6%), followed by Hastings (35.4%), Napier (33.7%) and Central Hawke’s Bay District (30.5%), with all areas still showing robust growth over the three months to the end of December − despite the increasing headwinds reported elsewhere in the latest QV House Price Index also having an effect on the region.

Though Napier’s rate of quarterly home value growth is steady at 4.4% − just 0.2% faster than the month before, and just 0.7% slower than the month before that − property values have gone from strength to strength in Hastings, growing by nearly twice as much (8.1%) as its neighbour.

Palmerston North

Have property values finally levelled off in Palmerston North?

In 2021, the city’s annual rate of home value growth was just 0.2% below the national average of 28.4% − but its most recent rate of quarterly home value growth is nearly a third less than the national average (7.8%) at just 2.7%.

From an April peak of 10.9%, the city’s rolling three-monthly rate of home value growth has continued to decline every month since, with the latest QV House Price Index recording just 2.7% value growth over the past quarter, arresting that slow and steady decline with the exact same level of growth as last month.

QV property consultant Olivia Roberts commented: “The market has continued to show growth, but the rate of that growth has slowed in the last four to six months. After all the government interventions in 2021 to try to cool the market, it appears the single largest effect in halting the market has been interest rate rises.”

“The lower price brackets still appear softer and the upper price brackets are stronger and appear solid with steady demand. The tipping point is around the $650,000 mark − any lower than this and the market appears to show slight weakness.”

“The number of listings continues to increase, adding more choice for buyers. It suggests a levelling in supply and demand may potentially be in effect,” she added.

Wellington

Residential property values increased by an average of 25.5% across the greater Wellington region in 2021, with the vast majority of that value growth occurring during the first half of last year.

The largest capital gains were on the Kapiti Coast at 31.1% for the year, with Upper Hutt not far behind on 30.1%. Residential property values increased by 22.2% in Wellington City, well below the national and regional average.

The Wellington region’s three-monthly rate of house value growth has generally trended downward since an April peak of 10.8%, with the latest QV House Price Index recording growth of just 3.2% over the last three months of the year. It’s a slight drop from the 4.2% value growth we reported last month.

Local QV senior consultant Blake Ngarimu commented: “As expected and in keeping with historical trends there has been minimal market movement over the month of December, with the exception of Upper Hutt which experienced value growth of 1.7%. So it was a relatively quiet end to a remarkable year that has seen the Wellington region experience an unprecedented level of value growth.”

“There has been a drop off in open home activity in the last few months of 2021, particularly at the lower end of the market. A clear indication that higher interest rates and toughen lending conditions are starting to have an impact on the market. The upper end of the market and well-presented properties in sought-after areas continue to attract a lot of attention,” Mr Ngarimu said.

“We note there is now more stock on the market − especially new homes and townhouses being offered for sale off of plans, giving purchasers more options. The recent increase of interest rates and tightening of lending growth will likely dampen value growth over 2022, with a more balanced and stable market predicted.”

Nelson

Nelson’s residential property market ended 2021 with a bang.

Home values increased by an average of 3.1% in December, and 7.2% over the last three months of the year. The city’s average home value finished the year at $886,179 − up 23.8% from the same time last year.

Local QV senior property consultant Craig Russell commented: “The Nelson property market had a strong finish to 2021 with a lack of available listings and pent-up demand continuing to drive up prices. However, we are seeing a shift in market dynamics as interest rates increase and the availability of credit becomes more challenging for first home buyers and investors. This has led to some properties sitting on the market for an extended period, largely due to vendor expectations being above market value.”

What can we expect in 2022? “We would still expect first-home buyers to struggle to enter the market given the high deposit hurdle that many face coupled with tightening credit criteria and increased servicing costs,” Mr Russell said.

“Land values increased significantly in 2021, which was driven by supply and demand. As more land is developed largely on the Richmond periphery it is likely that values will stabilise to some degree,” he added.

Canterbury

Canterbury was New Zealand’s fastest growing region last year, with home values rocketing up by an average of 38.3% in 2021.

The largest capital gains were in Selwyn District (43.3%), Waimakariri (41%) and in Christchurch city (40.2%). Across the much wider region, only Mackenzie District (10.8%) and Timaru (18.4%) didn’t experience 20% or greater home value growth last year.

Christchurch’s red-hot residential property market continued to blaze into 2022, with values increasing by 11.6% in the three months leading into the Christmas and New Year holiday period, which is only a small decline on the 12.7% rate of quarterly value growth we reported last month. The average value of a home in the Garden City is now $783,528.

Local QV property consultant Olivia Brownie commented: “We saw residential property values experience considerable growth for the region in 2021, yet we have finished the year with early signs that the acceleration of growth may be slowing, as anticipated with the continuation of tightening lending rules and increasing interest rates starting to have an effect.”

“We still predict the following summer months to see continued value growth due to the relative affordability of the region, but there are early signs that this value growth will eventually slow and perhaps flatten as the year continues. An increase in listings and a pipeline of new-build supply and re-development continuing in 2022 will also likely slow that market growth somewhat,” she added.

Dunedin

Residential home values climbed 19.6% in Dunedin last year to a new average of $725,853.

The city’s largest capital gains were on the coast and peninsular, where values increased by an average of 24.2%, but all areas of the city saw average home value increases of more than 18%.

QV area manager Tim Gibson commented: “2021 was certainly a bumper year for house price growth, especially during the first half. New regulations, rising interest rates, and tightening lending restrictions have taken some of the heat out of it now, and yet values have continued to rise every month.”

In the last three months of the year, property values increased by an average of 5.3%, slightly up on the 4.3% growth we reported last month. “It will be interesting to see what happens next. QV’s January and February figures may paint a clearer picture, but it certainly looks as though things should begin to taper off as the year continues,” Mr Gibson added.

Queenstown

2021 was a boom year for Queenstown’s residential property market, with the latest QV House Price Index recording annual home value growth of 27.2% − but local QV property consultant Greg Simpson says the market has begun to turn in favour of buyers.

“The number of new property listings has jumped this quarter. Those sellers who had been holding their properties off the market as long as possible to get the highest price are now stepping forward, concerned that they may have missed the peak,” Mr Simpson said.

“In coming months the rise in listings will also bring forth those vendors who have been holding off selling because they were fearful of not being able to buy again. This could be a sign that the property market is starting to turn in favour of buyers.”

He said that anticipated interest rate hikes would also likely have a cooling effect on the housing market. “It is increasingly likely that the Reserve Bank will also introduce debt to income (DTI) limits which reduce the likelihood of mortgage defaults and to support financial stability and house price sustainability. Overall there has been strong restraint applied to the housing market from tightening credit conditions.”

Invercargill

Home values continue to climb upward in Invercargill, with New Zealand’s southernmost city posting annual growth of 22.6% for the year.

December saw a busy end to the year with 2.4% value growth for the month, up on the city’s 1.1% monthly growth rate back in November. The city’s average home value on New Year’s Eve was $486,715, up 5.7% for the quarter.

Provincial centres, North Island

It’s an all-Waikato top three with Thames-Coromandel (43.8%), Waitomo (43.6%) and Waikato District (42.8%) finishing the year with the most annual home value growth on Aotearoa’s North Island. It follows a remarkable December quarter that saw Thames-Coromandel home values increase by an average of 13.7%.

Provincial centres, South Island

It was an all-Canterbury top three on the South Island, which is unsurprising given that the region also posted the fastest-growing average home value in the entire country this year. Selwyn District finished the year with 43.3% home value growth on average, with Waimakariri (41%) and Hurunui (38.7%) in second and third place respectively.

You can now view and keep track of all these value movements and more via our interactive QV House Price Index.