QV House Price Index, Feb 2021: Prices continue to surge with the onset of LVRs

Investors will remain a significant player in the housing market as the LVR speed limits imposed by the Reserve Bank kick in this month, according to Quotable Value (QV) general manager David Nagel.

The LVR speed limits returned at the start of March, but he said it might be quite some time before we see these significantly impacting the market. Most investors are now required to stump up a 30% deposit to grow their portfolio. Owner occupiers now require a 20% deposit from the start of March.

Mr Nagel said: “With capital gains averaging over 15% for the past 12 months, we’re still seeing many investors restructuring their finances to get around these restrictions.”

“Investors will need a 40% deposit from May 2021, which could finally dampen their ability to compete with the first-home buyers for the very limited affordable housing stock,” he said.

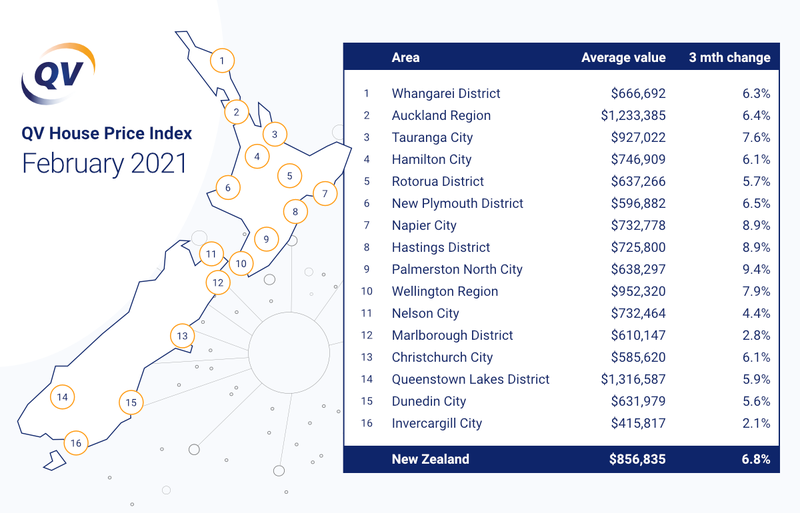

The average value increased 6.8% nationally over the past three-month period, up slightly from the 6.3% quarterly growth we saw in January, with the average value now sitting at $856,835. This represents an increase of 15.9% year-on-year, an increase from annual growth of 15.1% last month.

The average value in the Auckland region sits at $1,233,385, up 6.4% over the last quarter, with annual growth at 14.2%, up from January’s year-on-year growth of 13.4%.

All the major urban centres are showing strong gains in value, with Palmerston North continuing to lead the way with 9.4% growth over the past three months. The twin Hawke’s Bay cities of Napier and Hastings aren’t far behind with both cities showing quarterly growth of 8.9%.

“The larger centres were generally the first parts of the country to experience the very rapid value growth we’ve seen over the past 12-18 months, and this was primarily driven by both first-home buyers and investors competing for the very limited supply of entry-level housing stock. But the market strength has now spread to the higher-value locations in the major centres as confidence returns in the post-lockdown economic recovery,” Mr Nagel said.

“We may see a gradual cooling of the market in the second and third quarters of 2021, particularly in the entry-level locations as property investors reach their credit limits and first-home buyers struggle to raise a big enough deposit. But with the long-term forecast for housing demand in New Zealand looking positive, it is difficult to see the market take a significant turn for the worse any time soon.”

Auckland

February was another bumper month for Auckland’s residential property market, with prices up across the region by an average of 2.1%.

The average value of a home in the region is now $1,233,385 − though it’s considerably higher in Auckland’s central suburbs ($1,448,769) and on the North Shore ($1,408,604). Rodney ($1,129,186), Manukau ($1,080,765), Waitakere ($984,952), Papakura ($843,391), and Franklin ($791,434) all boast average house prices below the regional average.

The biggest price gains this quarter were made in Papakura (7.5%), followed by Rodney (6.9%) and central Auckland (6.3%). But even the smallest average house price increase this quarter − 5.9% in Manukau − was notable because of how large it was.

In the 12 months to the end of February, there has been double-figure increases in average house prices across the entire Auckland region. Once again, Papakura (16.5%) is top of the list, followed by Waitakere (15.6%) and Manukau (14.9%).

QV senior consultant Rupert Yortt commented: “The market is still very active with the level three lockdown only stemming the supply of listings due to the inability to hold open homes and auctions. All sectors of the market are performing well and the same patterns are continuing from last month, with the greatest buyer demand coming from the under-$1.5 million dollar mark where there is still good competition between first-home buyers and investors.

“We have also noticed a number of investors actively looking for properties, which could be an indication that they are motivated to purchase before even stricter LVR policies take effect.”

Mr Yortt said development land located close to shopping centres was attracting high prices, while there also appeared to be plenty of interest for home-and-income properties. On the North Shore, greenfields developments were attracting good levels of interest after a few years of slow turnover, and Te Atatu remained a hotspot in west Auckland.

“The LVRs and the likelihood of rising interest rates suggest that the market may stabilise in the winter months, despite the buoyant start to 2021,” he added.

Whangarei

The average house value in New Zealand’s northernmost city is now $666,692 − up 6.3% for the quarter and 2.6% in one month alone. In the past 12 months, prices have risen by an average of 15.5%.

QV property consultant Jeff Robinson said the local market was still very strong with pent-up demand for well-located properties. “Just over the last couple of weeks I have noticed many more listings coming on to the market, which continue to draw plenty of interest.”

Mr Robinson has witnessed the heat of Whangarei’s residential property market first-hand, with his daughter recently listing her own house on the market. “Already there has been a lot of interest,” he added.

Outside of Whangarei, demand for housing remained strong in Northland − particularly in Kerikeri, Dargaville and Mangawhai.

Tauranga

The residential property market cooled in Tauranga last month. The city’s average house price increased by just 0.7% to $927,022 − but it remains a staggering 17.8% higher than it was 12 months ago.

QV property consultant Derek Turnwald said there was a real sense that the market may be nearing its peak, which could cause some investors to sell the properties they had been holding onto while the market was rising.

“Agents are receiving less enquiries from New Zealanders living overseas now, possibly as a consequence of vaccine rollouts and increased confidence that there is finally an end in sight to the worst effects of the Covid-19 pandemic,” he said.

“Recent indications that the Government wants to reduce investor activity − particularly speculator activity − and restrictions on lending to investors could help to curb investor interest and activity, and therefore slow value growth across Tauranga.”

Hamilton & Waikato

Hamilton’s hot residential property market appears to be getting even hotter. The city’s average house price is now $746,909 − 6.1% higher than it was three months ago, and 17.5% higher than at the same time last year.

At 8.2% growth for the quarter, house prices in North West Hamilton have risen the most, followed by the South West (7.3%) and North East (5.9%). Interestingly, value growth has been considerably lower in central Hamilton (2.1%) − nearly four times lower than in the city’s North West.

Local QV property consultant Jarrod Hedley said it was largely the same story as previous months, with agents reporting strong demand. “The current sellers’ market is showing little sign of weakening as long as these market conditions continue to be present,” he said.

Meanwhile, Thames-Coromandel has recorded a strong quarterly increase in average median price, up 8.2% to $970,717. “Strong demand for property − particularly on the eastern side of the peninsula − will mean that, at this current rate of value growth, values should surplus the million-dollar mark in the coming months. It’ll be a first for a district in the Waikato region.”

Rotorua

Rotorua’s average residential property value continues to push to new heights. It crossed the $600,000 mark for the first time in January; by the end of February, it was already $637,266 − 15.3% higher than it was at the same time last year.

QV’s local property consultant Derek Turnwald said there was strong demand in all value ranges across Rotorua, but value rises had been particularly high in the suburbs where housing values were typically more modest, such as Koutu and Fordlands. “Competition is very high between investors and first home buyers in these suburbs,” he said.

“Demand has also been very strong for houses around the Rotorua lakes. One of the possible reasons for this is the inability to travel overseas has increased interest in our own local beautiful places − people have an increased interest in holiday homes with water views again.”

“Most listings are still resulting in multi-offer sales − with sometimes more than 10 offers,” he said. “There continues to be very strong attendance of open homes and auctions – although some agents are reporting a reduction in the number of appraisals they are being asked to prepare for prospective sellers, which could mean the number of future listings may be about to drop even further.”

Meanwhile, listing periods are amongst the shortest since records began, with FOMO still prevalent among first-home buyers in particular. “Very few properties are being sold now beneath a $400,000 threshold for an existing home or $500,000 for a new home,” he added.

New Plymouth

New Plymouth’s red-hot residential property market shows no signs of slowing down. The average house price is 17.1% higher than at the same time last year, and has increased by 6.5% in the past three months alone. The new average value of a home here is $596,882.

Local QV registered valuer Danny Grace said the Taranaki market continued to be very active in New Plymouth, Stratford and South Taranaki. “Agents, mortgage brokers and bank lenders in the region all report to be very busy,” he said.

“We have experienced market growth across all property categories, in all regions of Taranaki. Though the market has been strongest at the lower end, there have been recent big sales of higher value properties.”

Mr Grace said there was strong interest in well-located vacant sections, with continued busy building activity and the Marfell KiwiBuild project receiving strong interest. “Although more properties have come on to market during the summer months, demand is continuing to outstrip supply and we’re continuing to see low levels of stock, which is continuing to put upward pressure on prices.”

Hawke’s Bay

February was another big month for the residential property market in Hawke’s Bay. In one month alone, the average home value is 3.8% higher in Hastings ($725,800), and 4.8% higher in Napier ($732,778).

Local QV graduate valuer Damian Hall said the residential property market had “kicked back into gear” following a quieter holiday period. “Sales appear to be dominated by first-home buyers and investors alike, predominantly in the lower quartile, which has seen big movements in the past 12 months. The upper quartile has also shifted significantly with strong sales in the more sort-after areas.”

“With a shortage of land, lack of quality listings and accelerating demand, the market is not showing any signs of slowing,” he added.

Palmerston North

The average value of a residential property in Palmerston North has shot up 9.4% to $638,297 in just three months. That value is 24.1% higher than it was 12 months ago.

Palmerston North property consultant Olivia Roberts commented: “We continue to see buyer panic in the market as a direct result of a lack of supply. The market still appears to be the strongest at the lower end with agents reporting strong interest, typically leading to multi offers being received.

“However, there is still some uncertainty in the market and prices could still be affected by a range of factors − including restrictions, regulations or economic conditions related to Covid-19, particularly with the latest rise in alert levels across the country.”

Wellington

The latest QV House Price Index shows the average house price across Wellington increased by 2.1% last month, 7.9% for the quarter, and a staggering 21.3% over the past 12 months.

The smallest increase in average house price this quarter occurred in Wellington’s eastern suburbs (2.1%). Everywhere else saw increases of 6% or even more, with Hutt City (9.9%) and Upper Hutt (9.2%) leading the way.

Local QV senior consultant David Cornford said this rapid residential value growth was underpinned by a shortage of stock across the Wellington region, with low interest rates and continued strong demand also playing their part to keep upward pressure on prices.

“The Reserve Bank’s introduction of tough investor LVRs, coupled with the Government’s recent direction for the Reserve Bank to consider house prices when setting monetary policy, will likely see value growth taper off in the coming months,” he said.

“In the meantime, the market continues to be very competitive. Open homes have been well attended, multiple offers are the norm and we are seeing record prices being achieved. The rental market is also extremely tight at the moment, reflecting the shortage of housing in the Wellington region.”

Nelson & Tasman

Residential property values in Nelson have increased by 4.4% this quarter to a new average of $732,464. They have increased by 10.3% over the past 12 months.

QV senior property consultant Craig Russell said it continued to be a sellers’ market with demand exceeding supply. “Given the strength of the market, we have seen some properties transact well above asking prices and expected market levels. This is likely due to purchasers missing out on multiple properties and desperately wanting to secure one. This has contributed to a number of properties now being marketed via no price methods including deadline sale or tender.”

The QV Quartile Index shows there were more sales of residential properties in the upper quartile last month than in the lower quartile, across both Nelson and the Tasman district. “Properties in excess of $1,000,000 have been generating good interest with a number of properties receiving multiple offers,” Mr Russell added.

Christchurch

Christchurch’s residential property market has continued its exponential upward trend during February and has now increased 14% year-on-year and 6.1% in the past three months. The average value of a home in Christchurch has now reached $585,620.

The area of greatest growth is the peninsula, where the average house price has experienced a 20% lift in the 12-months to February, including 12.7% this quarter. The next biggest quarterly increase in the average residential house price occurred once again in East Christchurch (8.2%). It’s the second consecutive month that these two disparate areas have topped the list for quarterly growth.

The growth in greater Christchurch, across the Waimakariri and Selwyn districts, generally mirrors that of Christchurch with year-on-year growth of 10.8% and 9.9% respectively.

QV Senior Consultant Kris Rodgers commented: “Interestingly across both districts, QV’s Quartile Index shows that the lower and upper ends of the market are moving at similar levels, which is in contrast to the Christchurch market, where growth at the lower-end of the market has surged over the past three months compared to more steady growth at the upper end.”

West Coast

Across the great divide, QV Senior Consultant Kris Rodgers said the West Coast’s residential market was experiencing “unprecedented growth” with property prices in the Buller, Grey and Westland districts increasing by 23.9%, 14.1% and 18.7% respectively over the past 12 months.

“Multi offer situations are a common occurrence and there are reports of numerous sales to out-of-town buyers purchasing properties sight unseen,” he said. “In both Westland and Buller, the QV Quartile Index indicates that the lower end of the market is increasing at a greater rate, whilst the opposite is true in the Grey District, where the upper quartile is showing greater growth.”

Dunedin

Dunedin’s hot residential property market is showing no signs of slowing down during the early part of 2021. The city’s average house price has increased by 5.6% this quarter to $631,979, which is almost exactly the same rate as in last month’s QV House Price Index.

The biggest quarterly increase in average house price occurred on Dunedin’s peninsula and coast (6.3%), followed by Dunedin South (5.9%) and Dunedin North (5.5%). The smallest increase was in Dunedin Taieri (3.7%).

QV area manager Tim Gibson said this level of value growth had become “business as usual” for Dunedin’s residential property market. “There are no signs of the residential market levelling out any time soon, with high demand for all value levels and locations throughout Dunedin and low supply entering the market.”

Due to the difficulty to purchase, he said there was evidence that homeowners were upgrading their existing homes, rather than selling and upgrading. Meanwhile, rental demand was also high, with subsequently high rental growth.

Queenstown Lakes

Residential property prices have increased in the Queenstown Lakes District by 5.9% this quarter. The district’s average house value of $1,316,587 is 5% higher than it was at the same time last year.

Despite the lingering effects of travel restrictions and border closures on the local economy, QV property consultant Greg Simpson said there was limited disruption to the property market as a whole. “The price fluctuations experienced in the district post-lockdown are now no longer as evident, with high demand for property and strengthening value growth. Sales volume is also steady with reducing sales periods,” he said.

“In general, the local market has rebounded quickly from last year’s nationwide lockdown with growth in market volume that few commentators were expecting. Property management firms report that the residential tenancy market has now stabilised. Rental levels appear to have also found a stable equilibrium.”

Invercargill

Last month, we reported that the average residential house value in New Zealand’s southernmost city had climbed just 0.7% in three months. Buoyed by a busy February, that quarterly growth rate now stands at 2.1% and the average property value is $415,817.

QV property consultant Andrew Ronald commented: “We continue to see strong demand within the Invercargill market, with prices strengthening in January and February following the announcement of the Tiwai Aluminium Smelter staying open for another four years.

“Demand is strongest within the relatively affordable $300,000 to $450,000 range where multiple offers are common, often resulting in prices above initial asking price. Purchasers in this price bracket tend to be a mix of first-home buyers and investors seeking favourable returns compared to other parts of the country.”

He said listing numbers remained relatively low in the Southland region, which was keeping upward pressure on house prices.

Provincial centres, North Island

Wairoa leads all provincial centres this month. The average house prices in the Hawke’s Bay town has increased by almost 17% to $371,465 in just three months. It’s followed by Ruapehu – last month’s leader – on 14.8% growth for the quarter, and South Taranaki in third place (13.5%).

Wairoa also tops the list for annual growth over the past 12 months (31.3%), followed by Whanganui (30.0%) and South Wairarapa (27.7%).

Provincial centres, South Island

In the South Island, Gore is top of the list – and fourth overall across New Zealand – for quarterly price growth. The average house price here has increased by 13.4% to $354,885. Buller (11.2%) and Westland (11.1%) are second and third respectively.

In terms of average house price growth over a 12-month period, only fractions of a percentage point separate Buller (23.9%) from Gore (23.8%).

You can now view and keep track of all these value movements and more via our interactive QV House Price Index.