QV House Price Index, March 2021: House values continue to climb as new government measures announced

The Government’s new initiatives to quell the rocketing housing market were announced last week, just as house prices hit a new high for the end of March.

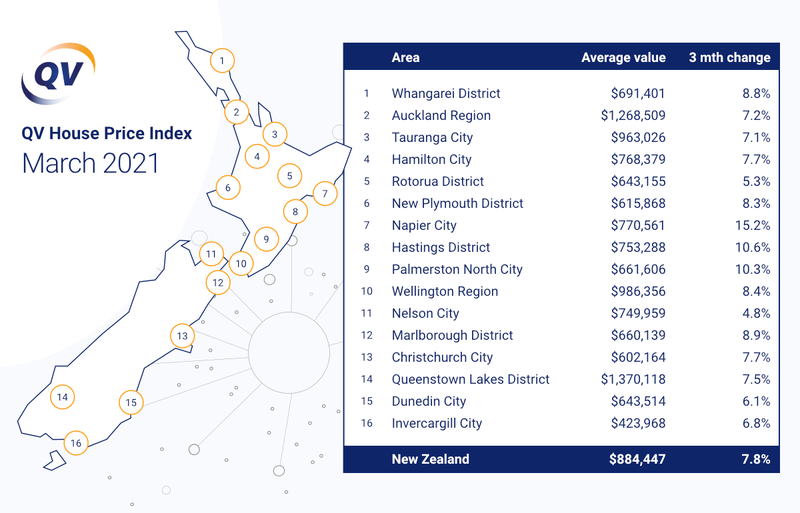

The average value increased 7.8% nationally over the past three-month period, up from the 6.8% quarterly growth we saw in February, with the national average value now sitting at $884,447. This represents an increase of 18.2% year-on-year.

The average value in the Auckland region now sits at $1,268,509, up 7.2% over the last quarter, with annual growth of 16.1%, up from February’s year-on-year growth of 14.2%.

All the major urban centres are showing strong gains in value, with the twin Hawke’s Bay cities of Napier and Hastings leading the way on 15.2% and 10.6% value growth respectively over the past three months. Palmerston North prices also continue to rise at a rapid rate with quarterly growth of 10.3%.

Time will tell whether the new measures announced by the Government last week will have an impact on rising house prices. Buyers, sellers, politicians and commentators continue to debate the merits of the changes and the likely impacts on house values and rents.

QV general manager David Nagel said: “This is not going to be a quick fix, but certainly the changes will impact the buying and selling habits of some investors. But any fall in activity from investors will likely be backfilled by increased demand from first-home buyers in the short term, so it’s hard to see prices coming down in a hurry.”

“It certainly sounds like it’s been a tough year so far for investors, with new Healthy Homes legislation impacting compliance costs for landlords in February, followed by the return of LVRs in early March. Last week's announcement to extend the bright-line test to 10 years, as well as phasing out interest deductibility will certainly make residential investment less attractive in the future. However the capital gains for seasoned investors have been quite exceptional for the past couple of years,” said Mr Nagel.

“March 2021 is a really great time to take stock of all the predictions and opinions on how the market will react to the Government announcements. It is exactly 12 months since the country went into level four lockdown, and everyone, including ourselves, feared for a catastrophic drop in the property market. 12 months on, we have seen record breaking growth in many locations, which has led to the government taking action to try to moderate this growth,” he said.

“This week, many commentators have given their opinion on how the market will react in the medium and long term, but the truth is – we don’t actually know. Any evidence of quiet open homes, empty auction rooms or values already on the turn is purely anecdotal at this point. The reality is that many investors will simply be taking stock of the new guidelines, digesting what it means for their property portfolio before making their next move or looking at alternative investments.”

Of the 16 major urban areas we report on, all except Queenstown reached double digit annual growth. But even the Queenstown market, which was forecast to struggle after Covid-19 hit, has increased 9.7% over the past 12 months, which corresponds to the time of our first lockdown.

The biggest mover was Palmerston North with annual value growth of 26.8%, followed by Hastings and Marlborough with 25.9% and 25% respectively. The Wellington region performed best of the main centres with annual growth of 24%.

“Property has been a proven investment performer and one would expect a certain inevitability that residential rents will rise over time, to at least partially counter the changes, which is no doubt an unintended consequence of the government announcements,” he said.

“The extension of the bright-line test probably won’t have a huge impact on investor behaviour given the majority already have a buy-and-hold approach to property investment. But the removal of interest deductibility will impact many investor appetites to grow their portfolio and may also deter new investors from entering the market,” Mr Nagel added.

Auckland

Auckland’s residential property market had another big month in March, with prices up across the region by 2.8%.

The average value of a home in the region is now $1,268,509 − though it’s considerably higher in Auckland’s central suburbs ($1,484,797) and on the North Shore ($1,446,321). Rodney ($1,156,000), Manukau ($1,115,176), Waitakere ($1,019,476), Papakura ($873,499), and Franklin ($811,376) all have average house prices below the regional average.

The biggest price gains this quarter were made in Papakura (9.4%), followed by Waitakere (8.6%) and Rodney (7.8%). But even the smallest average house price increase this quarter − 6.5% on the North Shore − is notable because of how large it was.

QV senior consultant Rupert Yortt commented: “The numbers again show strong growth for the month of March in the Auckland region. Growth of 6-10% in all Auckland sub-areas over the first quarter of the year reflects frenzied behaviour from buyers.”

“While it’s still much too soon to see the full effect of the recent government announcements on the market, a drop in demand is expected − especially with a portion of the investor market already trying to make purchases prior to stricter loan-to-value ratios being enforced.”

He said townhouses and apartments were increasingly in demand from first-home buyers. “Anything in the first-home buyer bracket will likely continue to be popular following the Government’s recent changes to the bright-line test and tax deductions on interest costs for rental properties, as this sector of the market is to be less affected.”

Meanwhile, he said development sites − one of the better performing property types over the past year − would also likely see continued demand.

Northland

The average house value in Whangarei is now $691,401 − up 8.8% for the quarter and 3.7% in March alone. Prices have risen by an average of 19.1% for the year ending 31 March 2021, with the majority of that growth (15.1%) occurring in the last six months.

Even further north, house prices in the Far North District have increased by 7% in the last three months and by 13.6% in the last 12.

Tauranga

Last month’s prediction of a cooling off in Tauranga may have been somewhat premature, with the average house price rising 3.9% in March alone (up from 0.7% in February). The average house price is now $963,026, which is a remarkable 21.4% higher than at the same time last year. The majority of that price growth (17.2%) occurred during the last six months.

Hamilton & Waikato

Hamilton’s average house value has increased by 7.7% this quarter to $768,379 − 19.6% higher than at the same time last year.

At 9.1% growth for the quarter, house prices in Hamilton’s north west have risen the most, followed by the south west (8.4%) and north east (7.7%). The smallest amount of value growth this quarter was in the south east (4.1%) − less than half as much as Hamilton’s top two fastest growing areas.

Local QV property consultant Jarrod Hedley commented: “Values continue to increase in the region with agents reporting good turnouts to open homes and multiple offers being tabled on a high majority of properties. Agents also report that there is strong demand for development properties and continued land banking of properties in central locations, particularly those on the fringes of established towns.”

As hinted in the last QV House Price Index, Thames-Coromandel has become the first district council in the Waikato to surpass the one-million dollar mark, now having an average median price of $1,006,031 which is up 19.6% in the last 12 months.

Meanwhile, neighbouring Hauraki District has had the highest 12-month growth in the Waikato, up 26.6% to $583,154.

Rotorua

Rotorua’s residential property market cooled somewhat in March, with prices rising by an average of 0.9% (down from 2.3% in February). The average price of a home here is now $643,155 − 14.6% higher than it was at the same time last year, and 5.3% higher than it was only three months ago.

New Plymouth

New Plymouth’s residential property market remains red hot. Its average house price has gone up 8.3% this quarter (up from 6.5% last month) to $615,868.

Local QV registered valuer Danny Grace commented: “Although we have seen more properties come to market during the summer months, demand is continuing to outstrip supply. Anecdotal evidence indicates that the recent announcements by the Government will detract from the appeal of property investment. We’ll continue to watch the market closely for any shift in the market.”

Hawke’s Bay

Residential property prices continue to grow in Hawke’s Bay. Last month, the average home value in Napier increased by 5.2% to $770,561 (up from 4.8% in February), and in Hastings it increased by 3.8% (the same as last month) to $753,288. Over the last 12 months, house prices in Napier and Hastings are up 24.4% and 25.9% respectively.

Local QV graduate valuer Damian Hall said FOMO (fear of missing out) was still a major presence in the local residential property market, but this behaviour may change as a result of the Government’s recent announcements. “It is still too early to tell how much these regulations will impact the market,” he said.

“The new regulations around tax and bright-line requirements may well open the door for first-home buyers and slow down rising prices. Alternatively these changes may be offset by rising rents from landlords who will now look to cover the increase in tax expenses, making it harder for people to save for their first home.”

He said property prices in the upper quartile (the 25% most expensive houses) were still showing strong movement. However, that part of the market was not as active as the lower quartile (the 25% least expensive houses) due to a lack of quality listings.

Palmerston North

The average value of a residential property in Palmerston North is now $661,606 − 10.3% higher than it was three months ago, and 26.8% higher than at the same time last year.

Palmerston North property consultant Olivia Roberts said there was strong competition for residential property across the Manawatu region, with lack of supply causing buyers to experience FOMO. However, she also warned of increasing levels of uncertainty in her local market, especially following the Government’s recent changes.

“There is some uncertainty in the market right now and prices could still be affected by a range of factors − most notably the Government’s recent intervention with its new regulations around tax and bright line requirements. But it’s still too early to tell what the full impact of these regulations will be,” she said.

“In the meantime we continue to see buyer panic in the market as a direct result of a lack of supply, with real estate agents continuing to report strong interest with multiple offers being received.”

Wellington

The latest QV House Price Index shows the average house price across Wellington increased by 3.6% in March, 8.4% for the quarter, and a massive 24% over the last 12 months − the most of all the main centres.

The smallest increase in average house price this quarter occurred in Wellington’s southern suburbs (5.2%) and in the west (6.6%). Everywhere else saw increases of 7% or more, with Hutt City (11.5%) comfortably sitting at the top of the growth charts.

Local QV senior consultant David Cornford said value growth remained strong throughout the Wellington region last month. “There continues to be a lack of supply and plenty of demand, particularly from first-home buyers,” he said.

“With recent announcements by the Government to swing the market in favour of first-home buyers and tougher loan-to-value restrictions coming into effect for investors, we are likely to see value growth start to slow over the rest of 2021.

“At this early stage it appears to be largely business as usual, but agents have reported strong interest for new builds and off-plan purchases as these are not impacted by the changes to interest deductibility.

“We are also aware of landlords who have already issued rent increases to tenants in order to compensate for the loss of interest deductibility. We expect to see more rent increases and investors decide to sell over the coming months, which could put further pressure on an already extremely tight rental market.”

Nelson

Residential property values in Nelson have increased by 4.8% this quarter to a new average of $749,959. That average value is nearly 13% higher than it was at the same time last year.

QV senior property consultant Craig Russell commented: “News that the first-home buyer price cap is increasing from $500,000 to $525,000 for an existing home and from $550,000 to $600,000 for a new build will be well received by some, but it’s not expected to have a dramatic effect on the local housing market.”

“Investors will likely be less active in the market as a result of the range of Government measures announced, and in particular the removal of the ability to deduct interest as an expense. This will likely be passed onto tenants in the form of increased rents.”

In the meantime, he said Nelson and the neighbouring Tasman region continued to be a sellers’ market with no-price marketing methods the most popular method of sale.

Christchurch & Canterbury

It’s been another busy quarter for Christchurch’s residential property market. The average house price increased by 7.7% in the past three months to $602,164 − 16.9% higher than at the same point last year.

Despite this level of continued growth, the exponential growth experienced over the summer has started to slow, according to local agents. QV area manager Kris Rodgers said the Government’s recent announcements could potentially help to cool the market further in the coming months.

“First-home buyers are still prevalent at open homes and auction rooms across the greater Christchurch area but it will be interesting to see in the coming months if there is a notable increase in first-home buyers choosing new builds,” he said.

Meanwhile, he said the Selwyn and Waimakariri districts had a “relatively good” supply of residential sections that were “generally being snaffled up as soon as they reached the market”.

“Accelerated population growth is forecast to continue in greater Christchurch over the coming years. The announcement of a proposed rezoning of 186 hectares of land south of Lincoln will help supply part of the equations as it is anticipated to create a further 2000 sections in the town.”

Dunedin

The Dunedin market continues to be characterised by strong demand and a significant shortage of supply, resulting in continued growth in all sectors of the market.

Annual growth to the end of March was 16.1% with the majority of that growth (12.8%) occurring in the last six months. The largest growth has been in the peninsula and coastal areas where values have increased by 11.2% this quarter. The average house price in Dunedin is now $643,514, up from $631,979 last month.

Senior consultant David Paterson said the Government’s new housing package had yet to impact the local market. “Investors are a significant part of the Dunedin residential market, with the central and north part of the city surrounding the university and polytechnic a significant residential investment locality. The general consensus is that investors will hold off now until they know exactly what the new rules are before making any more investment decisions.

“Meanwhile, the caps for the home start assistance to first-home buyers are still too low with too few properties available below a $425,000 price tag to help a significant number of buyers into the market.”

Queenstown

House prices in Queenstown increased by 7.5% during the March quarter to a new average of $1,370,118. Annually, prices are 9.7% higher than at the same time last year.

Despite the lingering effects of travel restrictions and border closures on the local economy, local property consultant Greg Simpson said Queenstown’s residential property market remained steady. “Property management firms report that the residential tenancy market has now also stabilised. Rental levels appear to have also found a stable equilibrium,” he said.

“The new measures just announced by the Government will eventually impact residential property ownership and accelerate the building of new houses. The likely cumulative effect is that that the market will reach a new equilibrium in a year or two with steadier house price rise growth and boosted house construction.”

Invercargill

The average house price in New Zealand’s southernmost city has increased by 6.8% this quarter to $423,968. That figure is 12.4% higher than at the end of March 2020.

QV property consultant Andrew Ronald said listings remained low, which was keeping upward pressure on prices. “We’ve seen continued strong demand within the Invercargill market with prices continuing to strengthen in March,” he said.

“Demand is strongest within the affordable $300,000 to $450,000 range where multiple offers are common, often resulting in prices above initial asking price. Purchasers in this price bracket have tended to be a mix of first-home buyers and investors seeking favourable returns compared to other parts of the country.”

Provincial centres, North Island

Carterton tops the list of provincial centres in the North Island with value growth of 16.8% over the last three months. It is followed by Stratford (16.5%) and Whakatane (15.4%).

Over the 12 months ending March 2021, house values in Carterton have increased by almost 40% − the most nationally by far. Whanganui is second (30.9%) and South Taranaki (30.1%) is third.

Provincial centres, South Island

Gore leads all provincial centres (and indeed all urban ones) with 18.1% price growth for the quarter ending 31 March 2021. The next-fastest growing provincial centres on the South Island over the March quarter are Westland (15%) and Southland (14.2%).

Buller (26.4%) tops the list of provincial centres on the South Island with the most price growth over the past 12 month period, followed by Gore (26.1%).

You can now view and keep track of all these value movements and more via our interactive QV House Price Index.