QV House Price Index, May 2022: Home values fall to levels of November last year

The latest QV House Price Index shows the housing market has fallen back to the same levels seen at the end of November 2021, as rising interest rates and credit constraints continue to bite.

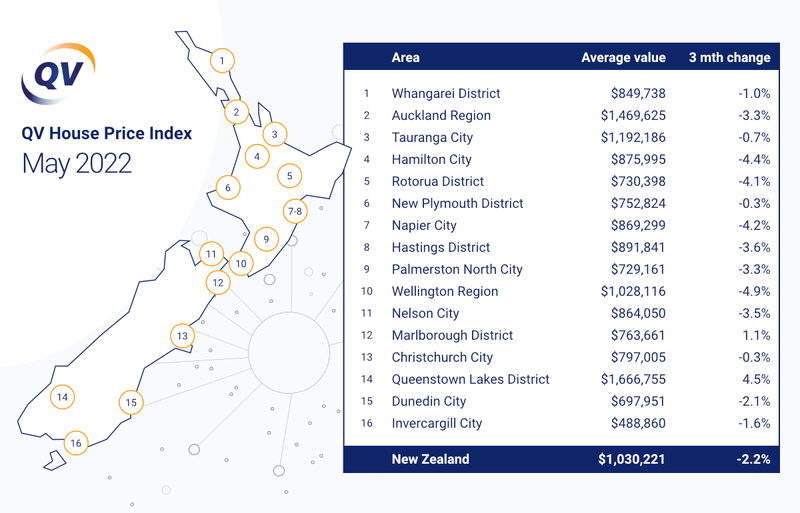

The average home decreased in value by 2.2% nationally over the past three-month period to the end of May, the same decrease in quarterly value change we saw in April, with the national average value now sitting at $1,030,221. This represents an average annual increase of 10.5%, down from 14% annual growth last month.

In the Auckland region, the average value now sits at $1,469,625, falling 3.3% over the last three-month period, with annual growth of 9.9%, down from the 14.2% we reported in April.

QV General Manager David Nagel commented: “There’s no question that prices are falling, especially now as buyers take the upper hand in negotiations. It’s really just a matter of how much further values will fall before finding the new equilibrium.”

Wellington and Hamilton are showing the largest three-month value reductions with falls of 4.9% and 4.4% respectively. Napier and Rotorua, at 4.2 and 4.1% reduction in values, are not very far behind.

Only two of the 16 major urban areas that QV monitors have shown an increase in three-monthly house price value, with Queenstown Lakes (4.5%) and Marlborough (1.1%) continuing to defy the downward trend in quarterly growth. Queenstown is the only major urban location to record an increase in the rate of value growth compared to last month.

“Almost all of the country has passed the value peak of the market cycle. This was originally driven by investors and first-home buyers competing for limited stock, especially with the availability of low interest loans. That led to massive value increases to the more affordable locations, so it’s no surprise these are the first values to get hit. But as the market downturn takes hold, even the higher valued properties have started being impacted now,” he said.

“With interest rates likely to climb further to battle inflationary pressures, as well as economic uncertainty with the Ukraine conflict and continuing supply chain disruptions, we’ve still got a way to go before the market bottoms out. We’re unlikely to see any significant value growth until at least 2023 when fully open borders might allow for the return of tourists and immigrants to New Zeaand at pre-Covid levels.”

Despite the latest quarterly value reductions, annual value growth continues to track positively with the average property in New Zealand increasing in value by 10.5% since May 2021. The Canterbury region has recorded the highest annual growth at 24.9%, while the lowest growth has occurred in the Wellington region at just 3.1% growth over the past 12 months.

Auckland

Home values dipped across the Auckland region by an average of 3.3% this quarter – with just one district managing to buck that trend.

The biggest losses were in Auckland’s central suburbs (-4.5%), Papakura (-4.1%) and Manukau (-3.7%), with North Shore (-2.7%), Waitakere (-1.7%) and Franklin (-1%) also showing significant home value reductions as economic headwinds continue to intensify.

At 2.8% positive home value growth for the three months ending 31 May 2022, Rodney was the lone exception to an otherwise region-wide downward trend that local QV registered valuer Hugh Robson said was likely to escalate as we move into winter.

“The Auckland residential market continues to slow down, with sale prices falling moderately over the past 4-6 weeks. It appears vendors are now realising the market isn’t what it was from June to Nov last year, and so they are now adjusting their price expectations in order to secure a sale agreement. Many auctions are ending without a result, with negotiations taking place later, behind closed doors,” Mr Robson said.

“With interest rates continuing to creep up, increasing living costs and material shortages, several developers have decided to delay starting multi-unit developments. First-home buyers with approved finance remain active. However most of them are now well aware the market changed in their favour.”

The average home value across the wider Auckland region is now $1,469,625 – still 9.9% higher than it was 12 months ago.

Northland

Northland’s residential property market reached a turning point in May.

Home values dropped across the region by an average of 1.3% last month, with Whāngarei and Kaipara now recording quarterly losses of 1.1% and 2.2% respectively. The average home value in these districts is now $849,738 and $931,759 respectively.

Meanwhile, home values in the Far North District still increased by an average of 2.2% this quarter, but it too saw a decline in May. The average home value there is now $777,921.

Tauranga

Home values continue to ease down in Tauranga, but at a much slower rate than many of the other main centres.

Its average home value dropped 0.7% this quarter to $1,192,186. Although that rate of negative home value growth is considerably smaller than the national average (-2.2%) it’s a far cry from the 7.7% positive home value growth we recorded over the last quarter of last year.

QV property consultant Derek Turnwald commented: “Demand for housing of all values has declined and is now generally subdued. Listing numbers have increased and listing periods are extending as supply increases and demand decreases. It is now a buyer’s market and, as a result, prospective buyers are likely to be playing the waiting game, holding off unless they find a property which is high in desirability or appears to be good value for money.”

He said FOMO (fear of missing out) had been replaced by a fear of paying too much. “Increasing interest rates are reducing many people’s ability to service a large loan. It’s likely that increasing interest rates and colder weather will result in continued subdued demand, at least until there is some clear evidence of how much values will decrease and when interest rates are likely to stabilise. This is unlikely to occur this year or next.”

Waikato

Home values dropped 1.8% across the wider Waikato region this quarter – and by considerably more in Hamilton.

Home values in Hamilton declined by an average of 4.4% over the three months ending 31 May 2022. The city’s annual rate of home value growth is now sitting at 8.1%, with all of that positive growth occurring last year; home values have dropped 4.9% over the first five months of this year.

QV registered valuer Tom Schicker commented: “With rising interest and inflation rates, market volatility is high and there is greater degree of economic uncertainty. The housing market in Hamilton is continuing to slow and agents are reporting an increase in the number of properties coming onto the market for sale.”

He said median home values had declined for all districts across the Waikato region this quarter, with Thames-Coromandel (1.3%), Matamata-Piako (0.6%), and Taupo (2.3%) the only exceptions to this downward trend.

Rotorua

Home values have declined in Rotorua, as they have throughout much of Aotearoa-New Zealand.

The average home value went down by 4.1% to $730,398 over the three months ending 31 May 2022, with the annual rate of home value growth now sitting at 7.7% – considerably less than the 22.4% rate of annual growth we reported for the end of last year.

QV property consultant Derek Turnwald commented: “Demand for residential property remains subdued generally, except for the upper value suburbs of Lynmore, Springfield and Matipo Heights, which are still experiencing reasonable demand, particularly from buyers relocating to Rotorua from Auckland and other major centres.”

“There is less interest in the lower end of the market, the homes typically targeted by investors and first-home buyers, which is likely to be due to a lack of confidence in the market, rising interest rates, and tighter lending criteria. Many first-home buyers and investors are now likely to be playing a waiting game to see how far property values will slide,” Mr Turnwald added.

Taranaki

Taranaki’s residential property market has cooled considerably from earlier highs – and yet it remains one of just a handful of regions with positive home value growth this quarter.

Much of that growth has occurred in Stratford, where home values have increased by an average of 10.2% throughout the first five months of this year. New Plymouth’s home value growth over that same period was just 0.7%, including a modest decline of 0.3% for this quarter.

The average home values in New Plymouth, Stratford, and South Taranaki are $752,824, $545,188, and $500,777 respectively.

Hawke’s Bay

Local QV registered valuer Damien Hall says “we have well and truly seen the peak in the Napier and Hastings property market”.

The latest figures show negative home value growth of 4.2% and 3.6% this quarter in Napier and Hastings respectively, with the average home value in these twin cities also sitting at $869,299 and $891,841 respectively.

“Lending restrictions and interest rate increases have changed the attitudes of many people towards the residential property market, which has seen a dramatic contrast compared to what we’ve experienced in the past two years. As a result, a lot of people are taking the wait and see approach for now,” said Mr Hall.

“The trend is becoming more consistent where the time to sell has been extended due to an increase in the number of listings, and existing homeowners looking to purchase are also somewhat restricted as a result.”

Across the wider region, Central Hawke’s Bay was the only district that recorded positive home value growth throughout the first five months of this year, at a relatively rapid rate of 11% no less. “Central Hawke’s Bay is still one of the more affordable areas in the region and a likely location for commuters and retirees. We expect that it will eventually follow the trend of Napier and Hastings,” Mr Hall added.

Palmerston North

Home values continue to dip in Palmerston North, sliding by an average of 5.2% over the first five months of the year.

The city’s 12-month average is still positive – for now – but at just 3.2% growth since the same time last year, it’s looking increasingly likely that it will dip into negative territory in coming weeks and months. The average home value is currently $729,161.

Local QV senior property consultant Olivia Betts commented: “The market is continuing in a correction cycle after a huge value surge at the beginning of 2021. Market movement has continued in a relatively consistent negative pattern this year. Downward price adjustments are being seen from listed properties as seller expectations are correcting to current market levels.”

“With interest rates continuing to increase, the cost of borrowing is making it more difficult for buyers – even with sale prices reducing. Economists have indicated that interest rates are likely to continue increasing, which also affects the general economy as disposable income reduces,” she added.

Wellington

The Wellington region has continued to experience a notable drop in home value levels over the month of May.

The average home value dropped by 3.1% last month in Porirua ($961,996), 2.1% in Upper Hutt ($881,499), 2.7% in Hutt City ($938,235), and 2.7% in Wellington city ($1,194,787). The neighbouring Kapiti Coast District ($976,071) has also recorded a modest decline of 0.6%.

In the last six months, Hutt City (-9.9%) has recorded the largest drop in average home value, followed by Upper Hutt (-7.4%) and Porirua (-6%). Only Wellington city’s central suburbs (2.8%) have posted a net gain over this period. Everywhere else has seen a decline in average home value since the market peaked late last year.

Local QV senior consultant Blake Ngarimu commented: “Due to the recent hike in the Official Cash Rate to what is now 2.00%, it is anticipated that interest rates will continue to climb, making servicing a mortgage, coupled with the current high cost of living, that much more difficult. As a result, agents have reported a number of deals falling through and a surplus of listings struggling to sell.”

“The fear of missing out has definitely gone and the fear of over paying has well and truly set in,” Mr Ngarimu added.

Nelson

Residential property values have fallen 3.5% this quarter in Nelson, with the number of property listings on the market continuing to go from famine to feast.

QV Nelson/Marlborough manager Craig Russell commented: “Purchasers have ample choice relative to this time last year, with inventory high and only a modest number of homes selling. As a result, we have seen a number of properties reduce their asking price in recent weeks. Entry and mid-priced properties in particular require sensible asking prices.”

“The upper end of the market is relatively firm, however, with quality homes in good locations still generating good interest. Kaiteriteri is an example of a location which has performed strongly relative to other locations,” Mr Russell added.

He said investor activity continued to be modest as they “battled the prospect of softening house prices, increased compliance and tax changes, and increasing borrowing costs”. “With rents closely linked to the tenants’ ability to pay, it is highly unlikely these additional costs can be fully passed on while inflation soars and ahead of wage growth.”

As a result of the softening market, Mr Russell said conditional contracts were becoming more commonplace. “Although these can draw out the sale process they provide both parties with the opportunity to complete important due diligence prior to the sale of a property.”

Canterbury

Home value growth continues to slow across much of Canterbury, with values climbing just 0.3% this quarter – down from the 1.6% we reported last month and 2.4% the month before.

Even Christchurch experienced some negative growth last month – the last of Aotearoa-New Zealand’s major cities to do so since the residential property market peaked nationwide at the end of last year – with values dropping by an average of 0.6% in May. The average indexed value now sits at $797,005, which represents a 12-month growth rate of 24.6%.

Local QV property consultant Olivia Brownie commented: “Anecdotally we are still seeing an active property market – especially for good residential homes, yet more buyers are placing more conditions on sales and negotiating sale prices.”

“We are starting to see some more realistic asking prices from developers for house-and-land packages on the outskirts of Christchurch and expect more of the same over the coming winter months throughout the region.”

Dunedin

The average home value decreased by 2.1% this quarter in Dunedin.

That figure is just a tick below the national average (-2.2%), with the average home value in Dunedin now sitting at $697,951 – 4.9% higher than the same time last year, and 3.9% lower than at the start of this calendar year.

“The greatest declines in home value over 2022 so far have been in the lower value areas, including north and south Dunedin,” said local QV registered valuer Rebecca Johnston.

“Vacant section sales have also slowed significantly compared to 12 months ago, with increasing interest rates, inflation and building costs making the dream of building your own home less desirable. This lag phase will likely not be realised by building companies for some months while current projects are completed.”

She said the Reserve Bank’s recent move to increase the OCR would “continue to take pressure off the housing market with continued predicted rises in the OCR through 2023”.

“Meanwhile, the trend in popularity for medium density housing including townhouses and units, has been further encouraged by the recent appeals decision on the 2GP rezoning in suburbs including Mornington, Waverley, St Clair and Green Island.”

Queenstown

On average, home values increased more in Queenstown this quarter than in any other main centre.

The average home value increased 4.5% to $1,666,755 over the three months ending 31 May 2022 – well above Marlborough (1.1%), which was the only other one of New Zealand’s main centres to post positive home value growth over this period.

Despite this recent spike in home value growth, QV property consultant Greg Simpson expected to see rising interest rates and tightening credit conditions continue to apply downward pressure on the local residential property market as a whole.

“We expect to see activity in the residential property market slow and prices ease,” he said. “Most economists expect that the OCR, which determines mortgage interest rates, will be further raised and are predicting a series of hikes to mortgage interest rates. This hiking in interest rates will have a cooling effect on the housing market.”

Invercargill

The latest QV House Price Index shows a slight reduction of Invercargill price levels for the second month in a row.

The average home value fell 1.6% to $488,860 in the three months ending 31 May 2022, on the back of two consecutive months of negative home value growth. Annually, home values are still 11% higher than at the same time last year.

Local QV registered valuer Andrew Ronald said this downward trend was “particularly evident for entry level housing, where there are now limited investors and fewer first-home buyers competing within the $350,000 to $550,000 bracket”.

“This is due to difficulties in obtaining suitable finance and rising interest rates. Good demand remains at the upper end of the market with several sales in excess of $1,000,000 in recent months. The lifestyle market remains strong, possibly a result of the preference for space and privacy following Covid forced periods of isolation,” he said.

Provincial centres, North Island

Though homes dropped in value by an average of 2.2% this quarter nationally, there continues to be pockets of relatively robust home value growth in the provincial centres. In the North Island, Stratford (10.1%), Central Hawke’s Bay (7.1%) and South Taranaki (5.3%) round out our top three for the three months ending 31 May 2022.

Provincial centres, South Island

Kaikoura (14%), Westland (6.6%), and Timaru (4.6%) experienced the greatest average amount of home value growth of the South Island’s provincial centres this quarter.

Keep track of all home value movements via our interactive QV House Price Index.