QV House Price Index, October 2021: Average residential home value cracks $1 million

The property market reached new heights last month with the average residential home value topping $1 million for the first time. This comes as large tracts of the country remain in level 3 lockdown restrictions, which seemingly hasn’t dampened buyer demand.

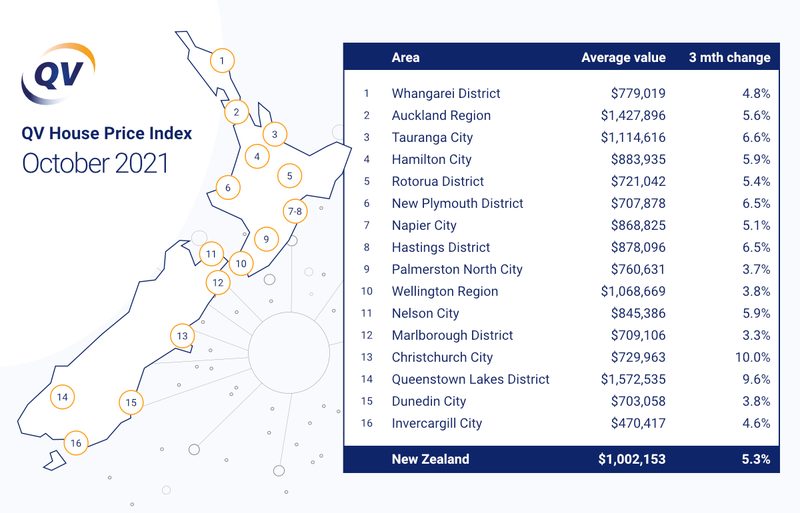

The average value increased 5.3% nationally over the past three-month period to the end of October, up from the 3.6% quarterly growth we saw in September, with the national average value now sitting at $1,002,153. This represents an increase of 27% year-on-year, up a fraction from the figure of 26.3% we reported last month.

In the Auckland region, the average value now sits at $1,427,896, climbing 5.6% over the last three-month period, with annual growth of 24.8% − up slightly from September’s year-on-year growth of 23.9%.

QV general manager David Nagel commented: “There’s certainly still buyers out there who are keen to commit to property transactions despite ongoing uncertainty around Covid-19 and the impacts this is likely to have on the economic recovery.”

“Credit availability continues to tighten as banks respond to RBNZ concerns around property market stability, particularly with interest rates on the rise. But a continued lack of supply has resulted in a resurgence in prices across all 16 metro locations we monitor,” he said.

“A reported flood of new listings will provide some welcome relief for house hunters. With interest rates rising faster than most initially expected, there appears to be an element of panic buying from those who have been in the market for a property for some time, keen to lock in a mortgage rate that’s still at historically low levels,” he added.

The strongest value gains for the main cities over the past three months have come from Christchurch at 10% growth in value, up from 7.7% value growth last month, followed by Queenstown Lakes District at 9.6% growth, building further on the strong three-monthly rate of growth of 9.4% we reported last month.

None of the 16 major urban areas QV monitors have seen a decline in average value, with all but Palmerston North and Napier at 3.7% and 5.1% respectively, showing an increase in the rate of three-monthly growth since last month.

The Manawatū-Whanganui region continues to be the strongest growing region with 34.7% growth over the past year, closely followed by the Canterbury region at 34.1%, while the Hawke’s Bay and greater West Coast regions have experienced annual growth of 33.9% and 32.7% respectively.

The three lowest annual growth rates are all in the South Island, with the Southland region experiencing a still-significant 20.4% increase, the Tasman region recording 22.1% growth, and Otago at 24.4% annual growth.

Auckland

Residential property values continued to increase across the Auckland region in October, even as Covid-19 restrictions hampered much of the local economy.

On average, they climbed by 2.6% last month, with the Auckland region’s three-month rolling average growth rate sitting at 5.6% (up from the 3.3% we reported last month). Its southernmost territories recorded the greatest amount of quarterly value growth − Franklin (7.5%), Papakura (6.7%) and Manukau (6.4%).

Of Auckland’s seven former territorial authorities that were merged to form the Auckland supercity just over a decade ago, now only Franklin ($963,651) has an average house value of less than $1m, with Papakura ($1,010,488) crossing the threshold for the first time last month. Manukau ($1,264,282) and Waitākere ($1,154,205) surpassed the same milestone within the last 12 months.

Local QV registered valuer Hugh Robson commented: “The market continues to be very active across the Auckland region, with monthly value growth exceeding 2% in all the major catchments last month. Development sites are in hot demand right now, a lot of multi-unit townhouse developments are currently under construction, and auctions are regularly being brought forward.”

Though the city’s current Covid-19 restrictions hadn’t yet slowed the market, he said that tightening lending rules from banks could have an effect on the local residential property market in the future, taking increasing numbers of buyers out of the market altogether.

Northland

Residential property values continue to rise across the Northland region, with QV’s latest figures showing a three-month rolling average growth rate of 5.7% − up from the 3.3% we reported last month.

The Far North has seen the biggest increase over that period with 8% value growth. Whangārei (4.8%) and Kaipara (4.2%) experienced a far-less-but-still considerable amount of value growth.

Annually, the average price of a home has increased by 27% in Whangārei to $779,019. In the Far North, that figure is $702,626, which is 30% higher than the same time last year. The average price of a residential property in the Kaipara district is $827,342 − up 29.2% since the same time last year.

Tauranga

Residential property values continue to climb upward in Tauranga, rising by an average of 2.3% in October and 6.6% over the last three months.

The city’s annual rate of house value growth is 33.8%, which makes Tauranga’s residential property market one of the hottest in the country over the past 12 months, with its average home value now sitting at $1,114,616.

QV property consultant Derek Turnwald said the number of property appraisal requests has increased markedly as the warmer weather has begun to set it. “Vendors want to list their properties during spring and summer when they are looking their best,” he said.

“Rising interest rates haven't dented people’s enthusiasm in the market so far. FOMO still exists and investors seem to have recovered their enthusiasm after a loss in interest for the five or six months following the March tax announcements by the Government.”

Mr Turnwald said there had been a noticeable drop-off in interest from investors in Auckland and Waikato − to be expected given current travel restrictions − with Covid-19 developments further afield also having an effect on the local residential property market.

“Enquiries from prospective purchasers living overseas have been falling away as the vaccination programme worldwide continues to roll on, reducing the risk of catching Covid-19. While in New Zealand we continue to grapple with an outbreak of Delta, which may be making the prospect of moving home less appealing for some.”

Waikato

Residential property values increased by an average of 2.5% across the Waikato region in October − up from the 1.2% we reported for September. But the region’s rolling three-month rate of value growth has remained steady at 5.1% for the quarter.

House value growth is tracking slightly ahead of the regional average in Hamilton city, where the average value increased by 5.9% this quarter to $883,935 − 27.7% higher than the same time last year.

Local QV property consultant Tom Schicker said Hamilton’s northeast and western suburbs had been the most active this quarter. “These areas continue to be the strongest performers, recording the most sales throughout October and also the highest increases in median house prices over the last three months,” he said.

“Agents are still continuing to report a shortage of quality listings, with the level of spring listings coming onto the market still not able to meet current demand. Demand for residential property remains high across all price brackets, with multiple offers being expressed for quality properties − especially ones that are well priced and well located.”

Mr Schicker said the market remained buoyant throughout the region, with the lone exception of Hauraki District, where house values dropped by 2.8% this quarter. “Waitomo and Ōtorohanga were standouts after a slow few winter months, with values increasing by 8.6% and 7% respectively over the last three months.”

Thames Coromandel District continues to have the highest median house value for the region at $1,173,369, which has risen 32.8% over the last 12 months.

Rotorua

Home value growth has been tracking a touch above the national average this quarter in Rotorua, rising 5.4% to an average of $721,042.

Despite home values rising by an average of 3.4% in October alone, property consultant Derek Turnwald said there was a sense that the market is peaking − particularly at the top end of the property ladder where properties are receiving much less interest.

“Much fewer people have been attending auctions and open homes,” he said. “With interest rates returning to their pre-Covid levels and banks tightening their lending criteria, it’s bound to marginalise a large number of prospective first-home buyers.”

In the meantime, Mr Turnwald said there remained a smaller-than usual number of listings in Rotorua’s residential property market. “Local agents have said that appraisal requests are rising, which is what you’d typically expect from spring and summer,” he added.

Taranaki

New Plymouth’s residential property market continues to smoulder, with values increasing by an average of 6.5% in the last three months and 28.3% annually.

It has been even hotter in Stratford District, where home values have increased by 34.7% annually. The neighbouring South Taranaki District has also experienced house value growth of 32.9% over the past 12 months.

Hawke’s Bay

Residential property values continue to push upward in the Hawke’s Bay region, where the twin cities of Napier and Hastings have experienced annual growth of 31.6% and 36.2% respectively.

Napier’s home values increased by 1.5% during the month of October to reach a new average price tag of $868,825, while the average home value in neighbouring Hastings increased by 2.9% over the same period to reach $878,096.

In Wairoa and the Central Hawke’s Bay District, house values have increased by 37.8% and 32.9% to $465,096 and $653,094 respectively over the past 12 months.

Despite continued strong value growth, QV valuer Damian Hall said the market was in something of a “holding pattern” currently. “This is due to the likes of Auckland and Waikato still being under strong lockdown restrictions, climbing interest rates, and a continuing increase in inflation which has evidently seen market activity slow somewhat,” he said.

“Agents in Hawke’s Bay are still reporting rising prices across the board and although demand remains high, the number of people attending open homes and auctions has declined. Investors are still not showing any sign of selling up to pursue other investments, but they don’t seem to be buying up large quantities of new builds either.

“This has opened the door for many first-home buyers without the competition of active investors in the market − although their numbers have declined as well. This seems to have occurred due to the introduction of Debt-to-Income-Ratios (DTIs) from the major banks which has made borrowing further more difficult as prices continue to rise.”

Although the demand for vacant land remained high, Mr Hall said he was seeing declining interest as many buyers were “fearing supply chain restrictions, volatile prices for materials and increased time to build”.

Palmerston North

House values continue to increase at a steadily declining rate in Palmerston North.

Over six consecutive months, the city’s rolling three-monthly rate of home value growth has gradually eased downward from an April peak of 10.9%, to 4.3% in September, and now 3.7% in October. The average value of a home here is now $760,631.

However, Palmerston North’s residential property market still remains one of the hottest of New Zealand’s main centres in terms of annual value growth at 33.9%.

QV property consultant Olivia Roberts commented: “We continue to see growth in property prices around the Manawatū area − however the rate of growth has slowed in recent months. Recent announcements regarding rising interest rates and income-to-debt ratios appear to be having a negative impact on the bottom end of the market. Real estate agents are reporting lower levels of demand in the market with a great deal of uncertainty also due to Covid-19.”

Wellington

Home values continue to rise across the greater Wellington region at an average rate of 1.5% in October and 3.8% for the quarter.

The largest value increase this quarter occurred in Kapiti Coast District (5.5%), followed by Hutt City (5.1%) and Porirua (3.6%). The smallest three-monthly value increases occurred in Upper Hutt (2.2%) and Wellington City (2.8%).

QV senior consultant David Cornford commented: “Values continued to increase in the Wellington region over October, but it is clear now that it's unsustainable. Headwinds including rising interest rates and tougher lending criteria are likely to dampen the market over the coming months.

“We have also seen more stock come onto the market over the last month, providing buyers with a bit more choice − although stock levels continue to be constrained. The increase in supply coming to the market will help moderate house price growth if new listings continue to come on board.”

Mr Cornford said demand remained steady from first-home buyers, but that many of them were finding it increasingly difficult to obtain finance. “Anecdotally we have heard that fewer offers are now being received and we are seeing more conditional offers are being accepted, a further sign that the market is slowing and may have peaked,” he added.

Nelson

Nelson’s residential property market continues to motor along, with the average home value rising by 2.2% in October and 5.9% for the quarter to reach $845,386.

Local QV senior property consultant Craig Russell commented: “Increasing interest rates have not had any noticeable impact on Nelson’s buoyant property market with properties selling readily and above vendor expectation in many instances.

“The fear of missing out has contributed to skyrocketing prices and supply constraints continue to impact the market. Marlborough Sounds properties have been extremely buoyant with strong interest particularly from out-of-town buyers.”

Canterbury

Christchurch leads all of New Zealand’s main centres for quarterly house price growth with values rising by 10% to a new average of $729,963.

Values increased by 4% in the Garden City of Ōtautahi last month alone, with the annual growth figure sitting at 36.1%. The city’s eastern suburbs (38.8%) have experienced the most value growth in that time, followed by the peninsula (36.8%) and southern suburbs (36.7%). The central city (27%) has experienced the least annual value growth.

Local QV property consultant Olivia Brownie commented: “The greater Christchurch area is continuing with strong market growth similar to the growth seen last month when we were just coming into spring. We are still seeing the same factors driving value growth − namely low supply, high demand, and relatively low interest rates.”

Meanwhile, house values continue to climb across the wider Canterbury region. Values increased by 13.9% this quarter in the Selwyn District, with the Waimakariri District not far behind on 11.1%. Annually, values are up in the region by an average of 34.1% on the same time last year.

“We are experiencing continued strong demand across the wider Canterbury region, especially from buyers wanting to lock in lower interest rates while they are still available,” Miss Brownie added.

Dunedin

Dunedin’s average home value crossed the $700,000 threshold for the first time in October.

Values in the southern city increased by 2% during the month of October and 3.8% for the quarter to reach $703,058, which is 20.3% higher than the same time last year.

QV area manager Tim Gibson said the local property market remained “hot”. “We appear to be in something of a holding pattern right now, with values continuing to push upward at a relatively steady rate. They’re not rising quite as quickly as previous peaks in the market, but it doesn’t appear to be slowing down either,” he said.

“Quality properties continue to sell quickly, especially ones that are well presented and well located. Lack of supply remains an issue locally, as it does for much of the country, with unrelenting high demand, even as interest rates begin to sneak up.”

Queenstown

Residential property values continue to push upward in Queenstown, rising by an average of 9.6% this quarter.

The average value of a home in Queenstown is now $1,572,535, which is higher than just about every former and current territorial authority that we monitor, except for Auckland city ($1,627,502) and Auckland’s North Shore ($1,597,533).

Queenstown’s average home value is 28.5% higher than the same time last year.

Invercargill

Residential property values continue to climb upward at a steady rate in Invercargill, rising 2.2% in October and 4.6% this quarter. The city’s average home value is now $470,417.

Local QV property consultant Andrew Ronald said favourable borrowing rates were still encouraging purchasers to the market, stimulating market activity. “We’re seeing continued strong demand for most property types. While investor activity may have dropped off in recent months, first-home buyers have more than made up for it,” he said.

“There continues to be limited stock available in Invercargill’s residential property market, which is fueling price increases. There is also strong demand for building sites throughout the wider Invercargill locality with price levels strengthening considerably over recent months.”

Provincial centres, North Island

Carterton tops the list of North Island provincial centres for house value growth this quarter, registering 10.4% on our latest QV House Price Index. It’s followed by Wairoa (9.4%) and Waitomo (8.6%). But Wairoa is currently in first place for annual growth (37.8%), with Whanganui (37.6%) and Horowhenua (37.5%) in second and third place respectively.

Provincial centres, South Island

The South Island provincial centres with the fastest rising house values this quarter are Selwyn (13.9%), Westland (12.5%) and Waimakariri (11.1%). Selwyn once again tops the list in terms of annual growth (39.7%), followed by Buller (34.7%) and Waimakariri (33.9%).

You can now view and keep track of all these value movements and more via our interactive QV House Price Index.