As the Reserve Bank ponders the likely introduction next year of measures to limit high debt-to-income lending, latest figures show Kiwis - particularly first home buyers - are continuing to stretch themselves further and further to buy houses

By David Hargreaves

How much higher can they go?

Debt to income ratios of particularly first home buyers are still going through the roof, a crunch of the latest Reserve Bank figures on residential mortgage lending by debt-to-income ratio (DTI) shows.

The latest figures show that over 70% of recent Auckland first home buyers (borrowing between them over $500 million) were doing so on a debt to income ratio of above five.

Ratios above five are regarded as high in the sense that the RBNZ follows them closely.

The RBNZ's DTI figures are released quarterly - but compiled monthly. As we usually do, we are comparing the last month of the latest quarter with the last month of the previous quarter (IE comparing June figures with those for March).

The latest figures are given additional significance by the fact that the RBNZ has now been given official sign-off by Finance Minister Grant Robertson for the introduction of some kind of DTI servicing instrument in the RBNZ's 'macro-prudential toolkit' - a toolkit that already includes the in-use loan to value ratio (LVR) restrictions.

The key sticking point for Robertson in agreeing to sign off on a DTI measure was the first home buyers - he didn't want them included, but has now conceded, with the provisio that "the Reserve Bank will need to have regard to avoiding negative impacts, as much as possible, on first home buyers..."

The latest figures show that in any DTI measure the RBNZ could hardly afford to exclude the FHBs - since they are the ones most gearing themselves up. In fact the latest figures showed that compared with three months ago the owner-occupiers were gearing themselves up, certainly in Auckland, by slightly less - although this was coming off a high level.

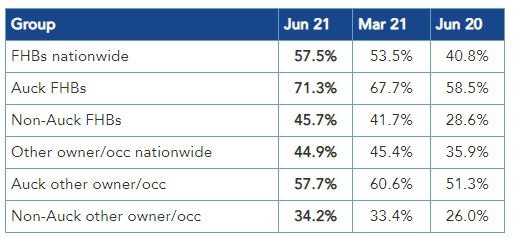

The detail shows that in June Auckland FHBs borrowed $766 million. Of this, $546 million - some 71.3% - was borrowed on a DTI of above five. That was up on the 67.7% ratio borrowed by the same grouping in March and 58.5% as of June 2020.

Nationally the FHBs borrowed $1.656 billion, with $953 million (57.5%) on a DTI over five. This is also up from March, and very well up on a year ago.

The Auckland owner-occupiers borrowed $1.742 billion, of which $1.005 billion (57.7%) was on a DTI of over five. This was actually down on the 60.6% recorded in March, but well up on the 51.3% of June 2020.

Nationally the owner-occupiers borrowed $3.83 billion, with $1.72 billion (44.9%) on a DTI of over five. That was down slightly from 45.4% in March but well up on the 35.9% of a year ago.

The table below shows the percentage of new mortgage money with debt-to-income ratios of over five times:

These figures look too high to be sustainable. Next thing is to see what the RBNZ does about it - now it can.

This story was originally published on Interest.co.nz and has been republished here with permission.