A Tale of Two Cities

Mainlander rugby fans heaved a massive sigh of relief when rules around Level 2 of the Covid-19 rules became clear and rugby could resume – albeit coming out of enforced hibernation to engage in a local derby competition featuring the five Super rugby teams playing two rounds each in stadiums bereft of spectators.

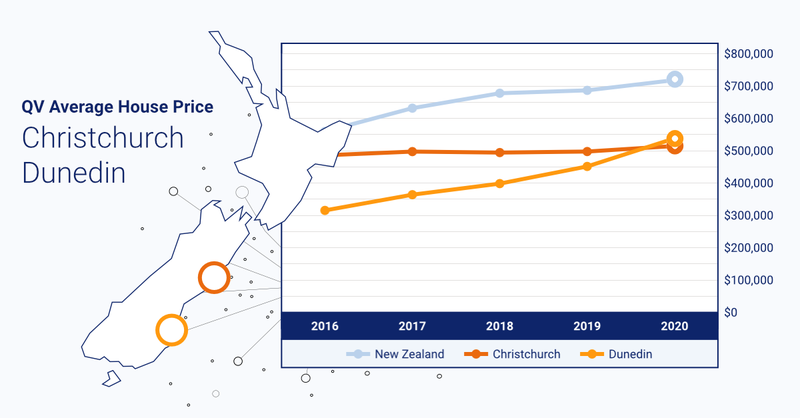

It will mark the return of the classic rivalry between Dunedin (Highlanders) and Christchurch (Crusaders) and the often highly anticipated bid for South Island rugby supremacy and bragging rights; this healthy competition compares well with the property market where Christchurch has historically had a much higher average value than Dunedin. But lately Dunedin has taken the lead. How long will this last?

QV’s area managers Kris Rodgers and Tim Gibson have tracked data that shows the Christchurch average residential value may be artificially lowered but both cities would seem to have favourable outcomes based on projected long-term construction activities.

It is well documented that since November 2019 the average residential sale price within Dunedin City has exceeded Christchurch City’s due to the spectacular value growth within Dunedin City (19.2% annual growth in March 2020) compared to Christchurch City (3.4%).

So, what’s been driving this large discrepancy in growth between the two largest South Island cities, and is the average sale price telling us the right thing?

DUNEDIN

There have been some significant long-term construction projects announced, the largest being a ten-year $1.4 billion project to rebuild Dunedin Hospital on the old Cadbury’s site. Otago University is also adding to the building boom with important spending on their existing building stock while also planning for new buildings in the mix. These projects have captured the eye of investors around New Zealand for potential good rental growth and security as well as attracting first home buyers wanting to enter the market, before they are priced out.

Add to this an average annual population growth of 1.1% from 2013 to 2019, along with a lack of vacant residential zoned land: this has resulted in placing significant demand on existing housing stock. A new district plan, which recently acquired legal effect, is promoting residential infill with some rezoning of low-density land to medium density. We are starting to see development within Mosgiel emerge but development within some of the other rezoned suburbs is on hold until infrastructure is upgraded, continuing the high demand for residential property and the upwards push in property values.

Post Covid – 19

It is early days but the limited sales data we are seeing on residential properties signed up during Alert Level 4 and into Level 3 show no signs of any negative value growth says QV’s Dunedin area manager Tim Gibson. “Agents are reporting demand is still there through their listing enquiries which are transitioning into sales. This appears to be a flow-on from pre-Covid-19 positivity. We are expecting this positivity to diminish along with value levels once the true impact of Covid-19 is felt with mortgage holidays and wage subsidies coming off, potential job losses as a result and any new lending reluctance from financial institutions coming to fruition.”

Christchurch City

To comprehend how Dunedin has surpassed Christchurch in terms of average house price over the last few years we need to consider the impact that the Canterbury earthquakes had on disrupting the Christchurch property cycle. Initially the earthquakes created a shortage of undamaged housing stock; the rebuild attracted domestic and international migrants, increasing rents and placing upward pressure on property values through to mid-2016. Christchurch was fast-tracked into the growth phase of the property cycle earlier than Dunedin and other regions due to this sudden shortfall in supply and increased demand. Satellite towns like Rolleston, Lincoln and Rangiora grew in size exponentially over this period and served to provide an alternative to consider for potential Christchurch home owners and investors in the market, new neighbourhoods offering well priced modern accommodation within a 20 – 30-minute commute.

The trading of damaged or ‘as is’ property in Christchurch has kept the average house price low with numerous construction companies having been established to specialise in the re-levelling and repair of earthquake damaged property. Thousands of damaged properties selling at around 50 – 70% of their undamaged value has dragged the average house price down significantly. This has been particularly evident in the east of Christchurch and in the hill suburbs.

In late 2019, with fewer ‘as is’ properties selling each year, in combination with good relative affordability and low interest rates, the market started to gain some traction and there was increased optimism amongst most property professionals. This continued right up until late March when everything came to a screeching halt and we were all confined to our respective bubbles.

Post Covid – 19

Christchurch is reasonably well positioned to fare better than other regions due to the aforementioned affordability levels and encouraging market activity that was preceded by a prolonged period of limited to no growth says QV’s Christchurch area manager Kris Rogers. “The workforce in the Canterbury region has a high proportion of ‘essential workers’ with more positive employment futures and there remains key construction projects in the pipeline that will create continued employment such as completion of the conference centre, the long-awaited multi-use arena and the continuation of large scale roading projects around the city.”

Dunedin v Christchurch?

When we compare the average sale price over the two cities, on the face of it there is no comparison with Dunedin City’s average residential sale price (March 2020) showing a record high of $538,000 compared to Christchurch City (March average residential sale price of $514,000). Clearly there is only one winner!

We have to keep in mind this average is calculated across all sales within the city’s boundaries. If we break down the average sale price into various sub groups, based on location, a different story is shown.

Dunedin City sub groups are very consistent city wide and range in an average sale price of $491,000 - $560,000. Christchurch City sub groups range $392,000 - $704,000 with the wide range attributed to properties selling in East Christchurch being made up of a high number of earthquake damaged properties. The eastern Christchurch sales are dragging down the total average sale price significantly. Excluding this group, we see an average sale price range $489,000 - $704,000 with the majority of sales falling in the $550,000 - $704,000 range.

Sorry Dunedin but it looks like another late intercept try to deny victory.