Thames-Coromandel residential rating values up 20.9%

New rating valuations show the average house value in Thames-Coromandel is now just over $822,000 – an increase of 20.9% since the district’s last rating valuation in 2017.

QV’s team of experienced, registered valuers has recently prepared new rating valuations on behalf of Thames-Coromandel District Council for 29,242 properties. They show that, on top of that strong increase in residential property values, the average land value has increased by 28.3% to $556,000.

QV property consultant Jarrod Hedley commented: “Residential house values have grown very strongly this year – particularly on the eastern side of the Coromandel. Though we’ve seen the most growth at the lower end of the market, there remains strong demand for beach-front property.”

“Over the last few months the market has continued to surge as a result of pent up demand post the initial lockdown. What we are seeing is a majority of buyers looking for semi-permanent holiday homes that are in accessible locations with good infrastructure and services.

“As people are becoming more flexible in their working conditions, demand has increased and housing stock on the market simply has not been able to keep up.”

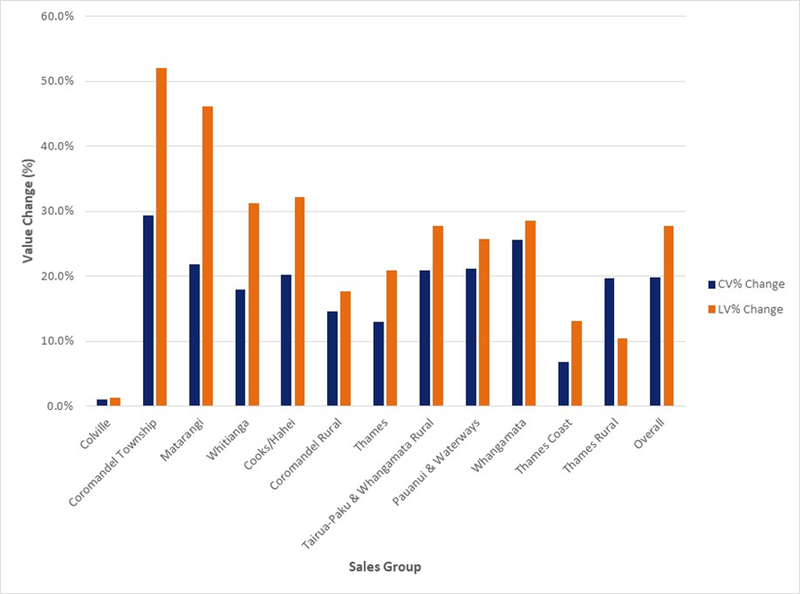

House value movements by location:

Meanwhile, commercial property values have increased by 27.7%, and property values in the industrial sector have increased by 18.5% since the district’s last rating valuation in 2017. Commercial and industrial land values have also increased by 31.6% and 32.1% respectively.

“Over the last three years commercial and industrial rentals have either remained static or increased slightly with yields strengthening depending on location,” said Mr Hedley. “However, there has been a lift in demand since lockdown.”

Since 2017, the average capital value of an improved lifestyle property has increased by 13.1% to $811,612, while the corresponding land value for a lifestyle property increased by 14.3% to $542,878.

“Premium prices are still being paid for properties with good views and locality features, with their still being resistance towards properties that aren’t as appealing to the market,” Mr Hedley added.

What are rating valuations?

Rating valuations are usually carried out on all New Zealand properties every three years to help local councils set rates for the following three-year period. They reflect the likely selling price of a property at the effective revaluation date, which in this case was 1 September 2020, and do not include the value of chattels (furniture, appliances, etc.).

They are NOT designed to be used as market valuations for raising finance with banks or as insurance valuations. They are independently audited by the Office of the Valuer General and need to meet rigorous quality standards before the new rating valuations are certified.

The Thames-Coromandel district’s effective rating revaluation date was 1 September 2020. Any changes in the market since then won’t be included in the new rating valuations. This often means a sale price achieved in the market today may be totally different to the new rating valuation.

New rating values will be posted to property owners this week. If owners don’t agree with their rating valuation, they have a right to object through the objection process before 22 January 2021.

Find out more about the rating revaluation and objection process.